StoneCo’s Elevated Take-Rate Yields $350 Million Buyback

| Price $10.90 | Growth Holding | November 27, 2024 |

- Recently announced $350 million repurchase agreement, representing more than 10% of shares.

- Despite pressure from low-cost payment architectures, STNE has been able to maintain a high take-rate thanks to value-added services.

- Management indicated it may sell off the software arm to run a more lean and transparent business.

- Obtained banking license in early 2024, allowing it access to cheaper funding and increases the stickiness of the business model.

- Brazil has a fragmented payments industry with ample cross-selling opportunities.

Investment Thesis

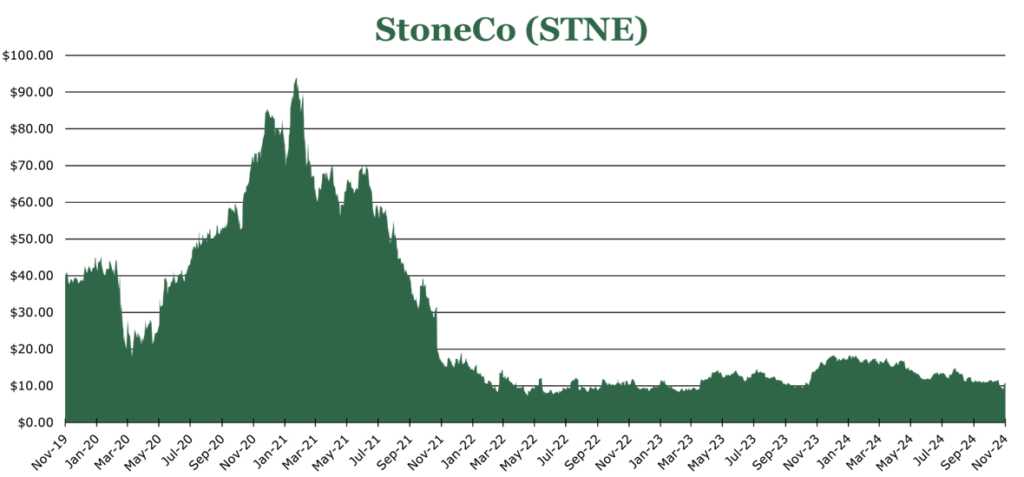

StoneCo (STNE) is a Brazilian fintech providing hardware solutions for SMBs (small-medium business) and provide payment acquiring services. Since the start of the year, STNE’s stock price has declined by more than 40% and now trades at just 8.8x earnings.

We think that despite some short-term macroeconomic headwinds in Brazil, STNE has a strong business model that has gotten sticker since it was approved for a banking license in early 2024. Additionally, management has indicated that they may sell off the Linx software business and focus on running a more transparent, asset-light SMB-focused business.

On November 21st, management released a new share repurchase plan to buy back $350 million in shares, or about 10.2% of shares. This repurchase agreement will increase earnings in the short term and will offset any headwinds from macroeconomic conditions in our view.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E25 EPS X P/E = $1.4 X 16.0 = $22.40

Large repurchase agreements, additional management transparency, and running asset-light should push the P/E back toward its long-term average of 20x.

| E2024 | E2025 | E2026 | |

| Price-to-Sales | 1.3 | 1.2 | 1.1 |

| Price-to-Earnings | 8.76 | 7.33 | 6.36 |

Market Conditions

The Brazilian central bank is widely expected to continue to raise rates, which has led management to comment that they expect a “more challenge scenario” for the final quarter of the year. Inflation re-accelerated to 4.76% in Brazil, with the central bank raising its year-end estimate to 4.4%, compared to the previous 4.25%. The central bank is now targeting 11.25% on the overnight rate— the 10Y in Brazil now trades at 12.9%, and the 2Y now trades at 13.3%.

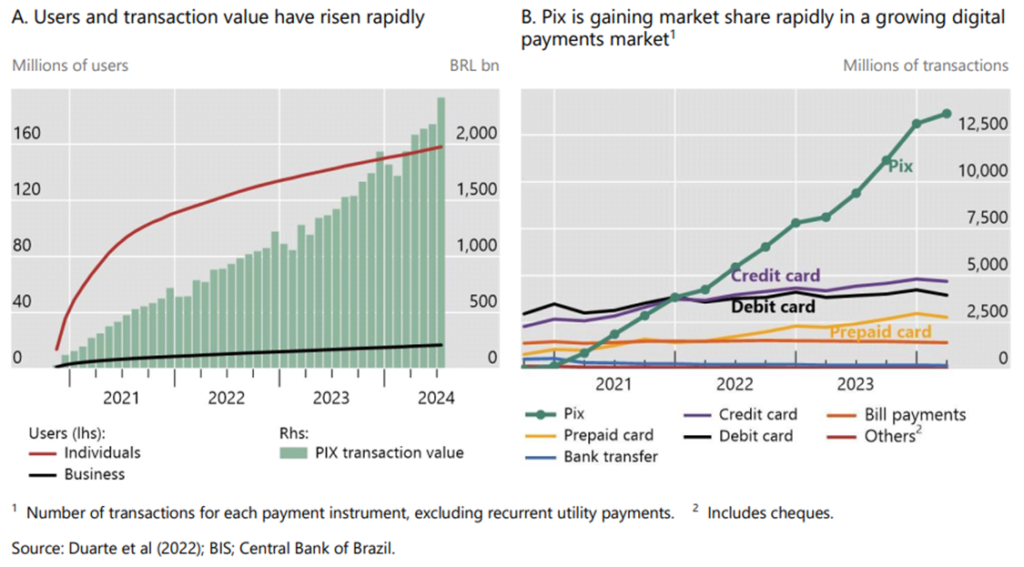

Pix, introduced by Brazil’s Central Bank in November 2020, is a 24/7 instant payment system that supports P2P, P2B, and B2B transactions.

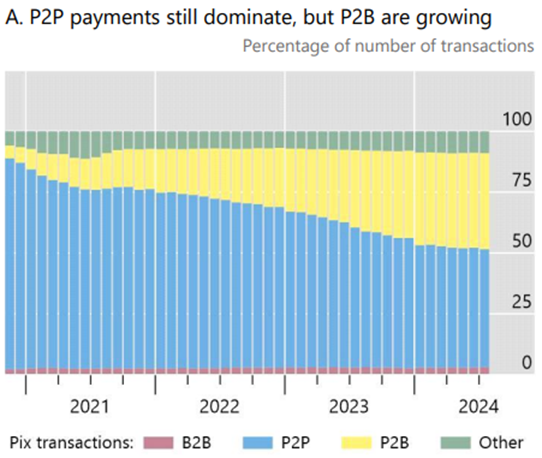

An estimated 90% of the adult population of Brazil has utilized Pix since its introduction and it has grown to be 43% of the cashless volume in the country. We expect Pix to surpass 50% market share by the end of 2025. Several banks and fintech’s have introduced the ability to use a credit card or BNPL (buy-now-pay-later) to settle Pix transactions which should rapidly increase P2B adoption in the place of traditional card settlement networks.

Regulatorily, large banks are mandated to participate in the program and associated regulation has banned exclusivity deals between banks and non-financial firms. Payment acquirers like STNE are permitted to collect fees on Pix transactions, but they are much smaller than the existing average.

Payment Acquiring

STNE’s core business offers hardware and software solutions for SMBs (small-medium businesses) to take payments, access credit, and other ancillary services.

As a payment acquirer STNE takes a fee out of every transaction processed, with a payment volume of $19.6 billion for the quarter ending September 2024, a 22% CAGR since 2022 and expects to end 2024 with 18% year over year growth.

While this is a deceleration compared to pre-2021 figures, we attribute the slowdown to management focusing on boosting take-rate among existing clients in the face of macroeconomic and regulatory conditions rather than maturity in the addressable market.

| Method | Take Rate | Estimated Market Share |

| Pix | 0.22% | 40% |

| Debit Cards | 1.13% | 20% |

| Credit Cards | 2.34% | 36% |

| STNE Blended | 2.58% | – |

Transaction fees represent 24.7% of STNE’s quarterly revenues and despite reporting a blended take rate increase of 9bps since 2023 and a total payment volume increase of 20% year over year, transaction fee revenues fell 4.6% year over year.

In our view, this indicates that take rates from acquiring alone are decreasing, but other value-added services are getting enough penetration to offset it. Per STNE management, offering things like better contactless payment on terminals, dynamic QR codes to prevent fraud, and other upsells into STNE’s banking services has kept rates up.

During the earnings call for the quarter ending September 2024, STNE indicated that Pix will provide net economic benefit over the long-term. In our view, this benefit will come in the form of Pix replacing cash and improving overall penetration for STNE’s banking and hardware services offered. Since 2019, the amount of cash withdrawals from Brazilian financial institutions has fallen by 36%. We see parallels between Brazil’s advancements and rapid adoption of Pix and the development of digital payments in China. In China, even small-scale traditionally cash businesses acquired hardware or software to process the ever-increasing number of digital payments.

Linx

We fully expect STNE to sell off the enterprise software business, Linx, which represents about 12% of revenues and provides ERP and data services. The Linx acquisition, which cost STNE approximately $1.3 billion USD, has failed to deliver meaningful incremental top or bottom-line growth due to integration issues and a mismatch in target markets.

Management noted during the earnings call for the quarter ending September 2024 that they are exploring options for the future of Linx, including a sale and have a group of “more than 20 players” that are potential buyers. According to BB Americas Bank, Linx’s estimated value has fallen to between $360 – 650 million USD. We expect the sale proceeds to be used to repurchase additional shares or pursue horizontal expansion opportunities to bolster SMB offerings.

During earlier management discussions, STNE had stated that owning Linx was a good sales funnel for banking services. However, now that STNE holds a banking license with high product uptake, it is likely that there is additional pressure to sell rather than hold onto an unproductive segment. Running on an asset-light model in times of economic stress could provide much-needed flexibility, especially if STNE was able to secure partnerships with other providers to keep an important sales funnel.

Credit Services and Banking

In January 2024, STNE acquired a banking license. The license allowed STNE to begin to take deposits from its merchant customers, reaching $1.2 billion in deposits for the quarter ending September 2024, 53% year over year growth in deposit level. STNE reported 88% new client uptake, with 34% of STNE clients utilizing 3 or more STNE services.

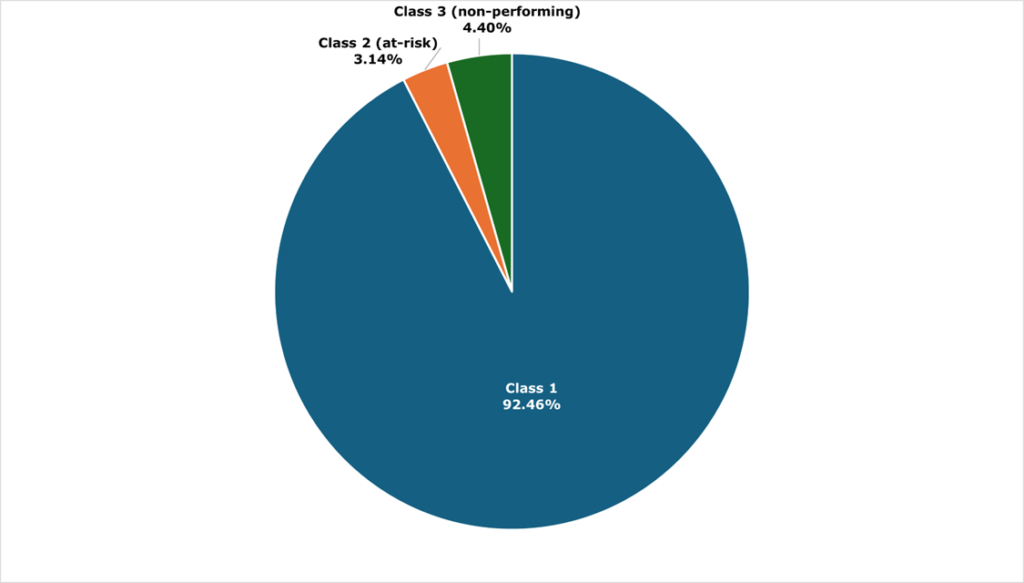

Currently, STNE has not announced plans to extend the banking arm into traditional consumers or issue more traditional small business loans. However, STNE has bolstered its credit offerings for SMBs, including a BNPL service for small businesses to pay for larger purchases using future receivables. As of the quarter ending September 2024, STNE had $160 million in gross outstanding credit products, a 30% increase year over year, with 6.3% being business credit cards and the remaining being other revolving credit products.

In the future it is possible that STNE will extend traditional credit products to customers, has issued a small amount of time deposit products to demo customers. However, with the Brazilian CDI interbank rate (the traditional marker for time deposits in Brazil) being 9.29% compared to the overnight rate being 11.25%, the return of lending to customers at this time may not be attractive enough to build out large-scale financial product infrastructure.

Even without traditional lending services, acquiring customer deposits increases the stickiness of STNE’s services and increases switching costs. Over the long-term as interest rates come down and the Brazilian economy continues to develop, we think it is possible that STNE could introduce more traditional banking products as the economic situation on Brazil improves. However, currently it is an unattractive market in the short term, and thus will not be introduced before 2027.

Risk

As previously discussed, inflation and Brazil has re-ignited. The benchmark overnight rate has increased to 11.25%, and with the 10Y trading at 12.9% and the 2Y trading at 13.3% the market is pricing in several more rate increases. This will directly increase the cost of funding for STNE.

The Brazilian central bank is also planning to introduce Pix Garantido to replace traditional credit and BNPL networks. Details and specifics are incomplete right now, and the launch date keeps getting moved around – now slated for June 2025. We see this as a mixed outcome for STNE. BNPL services in Brazil previously sat on top of credit card networks, meaning high realized fees. The movement of BNPL architecture to Pix would put pressure on margins but would undoubtedly increase volume and access to credit in the Brazilian economy.

Take-rate pressures from Pix-linked services may force STNE to increase the price for its services over time which could create switching pressure especially if Brazilian consumer spending meaningfully deteriorates. However, the introduction of integrated banking solutions to offerings will make the barriers for exit much higher.

Financials

For the 9 months ending September 2024, STNE saw overall revenues increase by 9.5% year over year. Overall expenses only grew by 3.5% over the same period, and the increase in interest income brought net income margin up 296bps to 16.9%.

Brazilian banking regulations have the potential to require financial institutions to keep 100% of customer deposits on hand in reserves at the central bank, or in government securities. At this time, the ratio is 21%. In non-restricted cash STNE holds $805 million which is around the typical level. STNE has a net debt to EBTIDA of 0.93x for the trailing twelve months, and an interest coverage ratio of 3.8x. Given the cash on hand we consider there to be a solid margin of safety.

On November 21st, STNE authorized a share repurchase of around $350 million or around 17% of shares at the time of the announcement. Post rally, this still amounts to 10.2% of shares and should meaningfully boost earnings per share. Management stated during the quarter ending September 2024 that they plan to release more visibility on their capital decision making framework, which we foresee boosting investor confidence.

On the risk side, STNE has allowance for losses of around 13.5% of issued credit products and a non-performing loan ratio of around 7% across all types of credit. While this is high for a developed country, Fitch estimates that around 50% of revolving operations at Brazilian financial institutions were non-performing thanks to average interest rates on revolvers breaching 100% APR.

Conclusion

The barriers for entry for digital payments in Brazil are decreasing, which should meaningfully increase processed payment volumes for STNE but also pressure pricing power. Despite added take rate pressure from digital payments, STNE has been able to increase its blended take-rate thanks to value added services. Some of these services include banking deposits, which we believe makes STNE’s business model far more sticky. Additionally, STNE trades at just 8.8x earnings and has recently announced a large-scale buyback which will increase earnings power over the short term. Thus, we believe this marks a good entry point.