Financial Planning

planning for every milestone

Earning Years

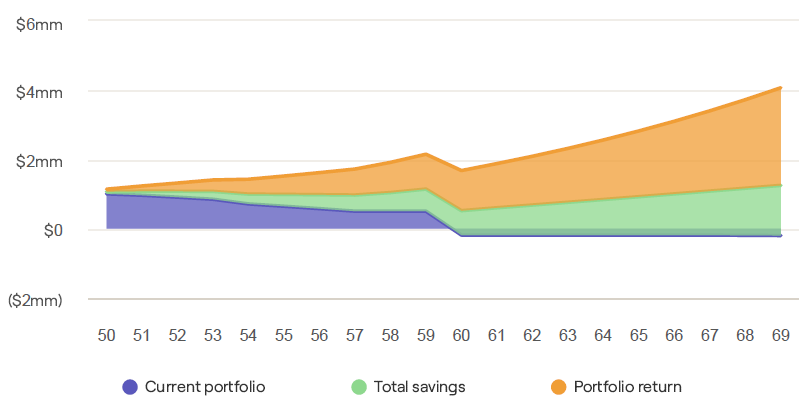

Savings isn’t just putting away money; it’s making your money work for you in the smartest way possible.

We’ll help you understand how to make the most of your savings, whether it’s choosing the right account, understanding interest rates and limits, or figuring out how much to invest each month.

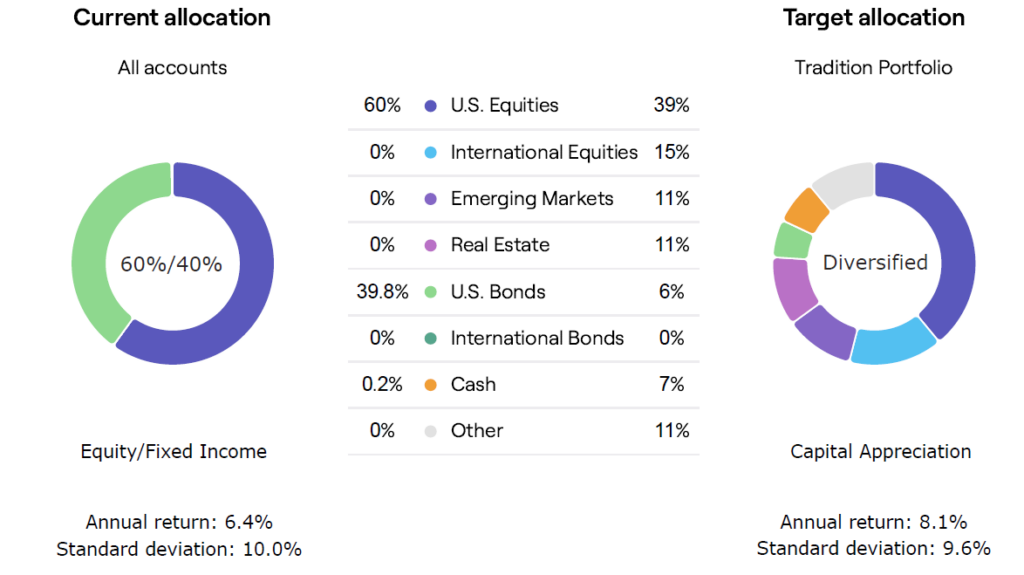

In addition, we offer choice in asset allocation based on your risk tolerance and financial goals. This allows us to provide you with the optimal risk adjusted returns and help you reach your retirement goals.

Retirement

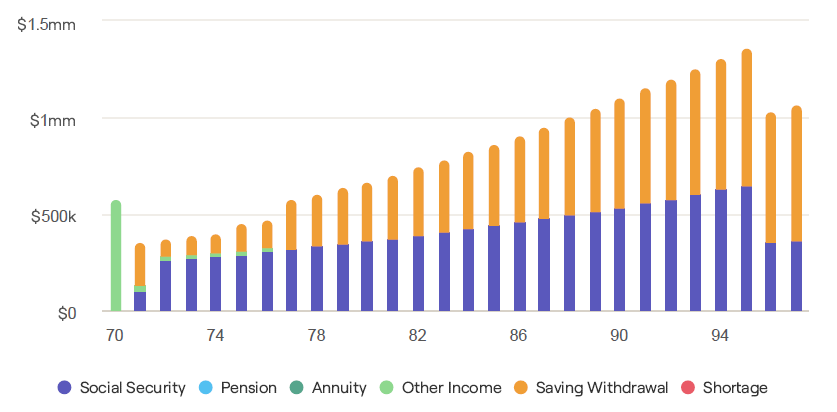

Our team is here to navigate the complexities of retirement planning for you. From figuring out the right distribution plan, understanding pension funds, to making smart investment choices, we’re here every step of the way.

Once it comes time to retire, we will guide you through the options for drawing down your assets in a tax-efficient manner. We will help you understand the implications of each choice, and ensure that your decisions are in sync with your broader financial picture and wishes.

Generational Wealth

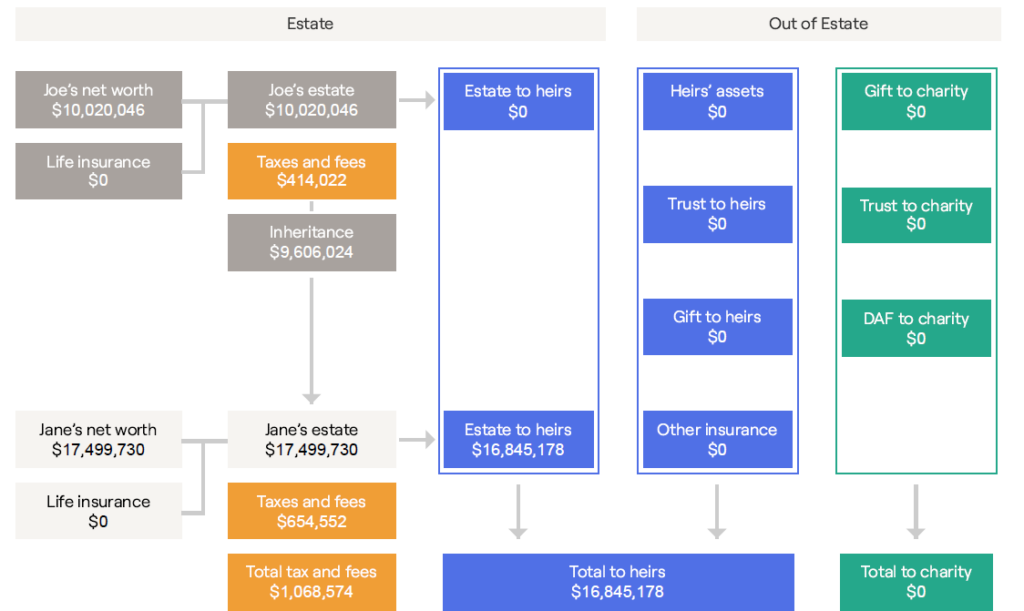

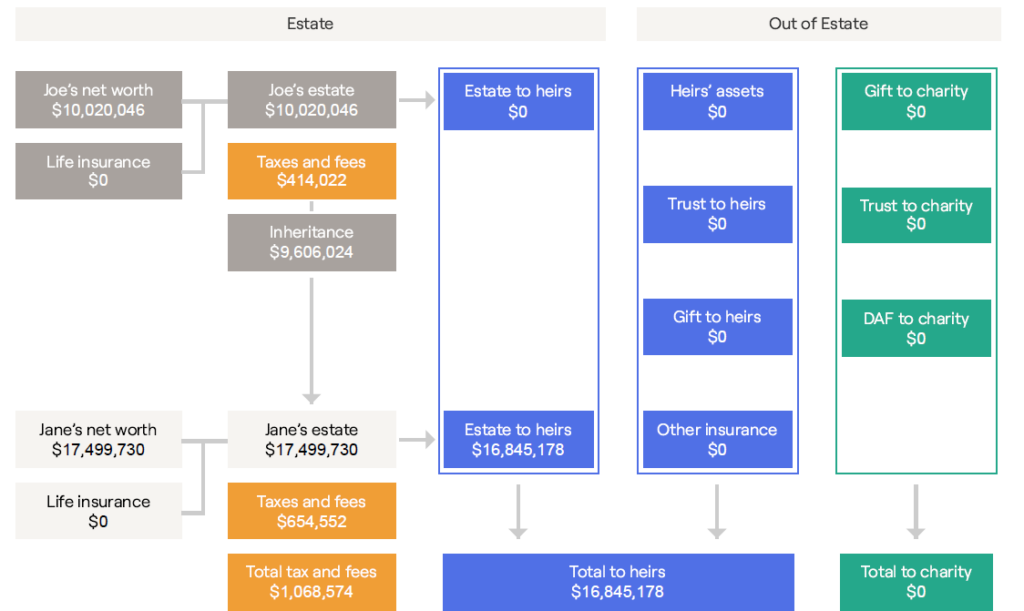

Estate planning is a vital process that ensures your assets are managed and distributed according to your wishes, both during your lifetime and after.

Our comprehensive approach addresses key components such as establishing trusts, minimizing taxes, and planning for the unknown. We focus on protecting your assets, ensuring you establish a family legacy.

Regular updates to your plan ensure it evolves with your life’s changes. Let us guide you through this crucial process, giving you peace of mind that your legacy is established and your loved ones cared for.

Saving Years

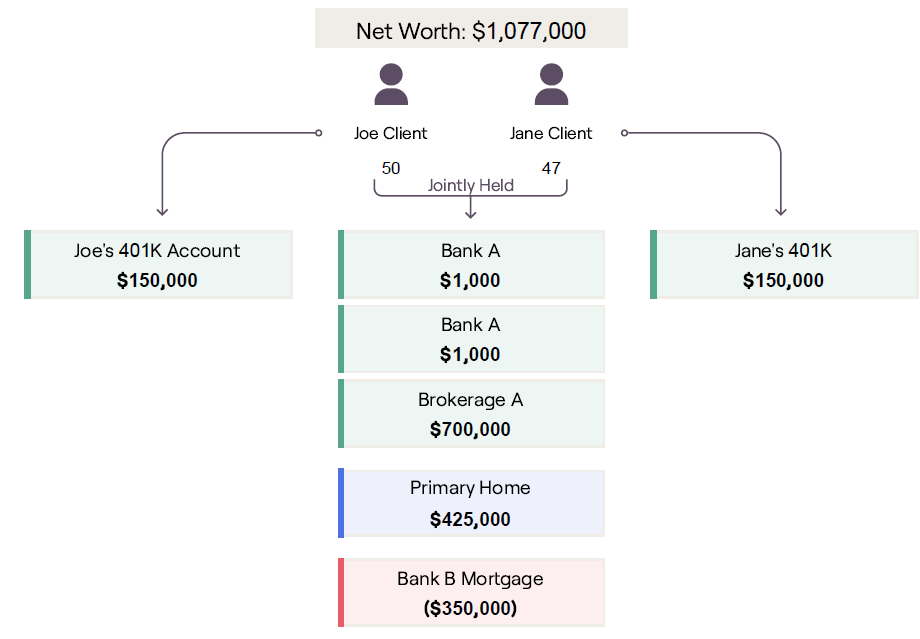

Debt management is a crucial aspect of your financial health, and we understand that each liability represents more than just numbers—it’s part of your broader financial narrative.

Whether it’s a mortgage for your family home, purchasing a vacation home, or even a boat, we are here to guide you through it.

Snapshot - Your Retirement Dashboard

Data is for demonstration only. Tradition Investment Management is not in any way affiliated with Right Capital, and the example report and example data below does not constitute any offer or investment advice. This is only used as an example of a report that we might provide to clients.

Overview

Proposed Plan

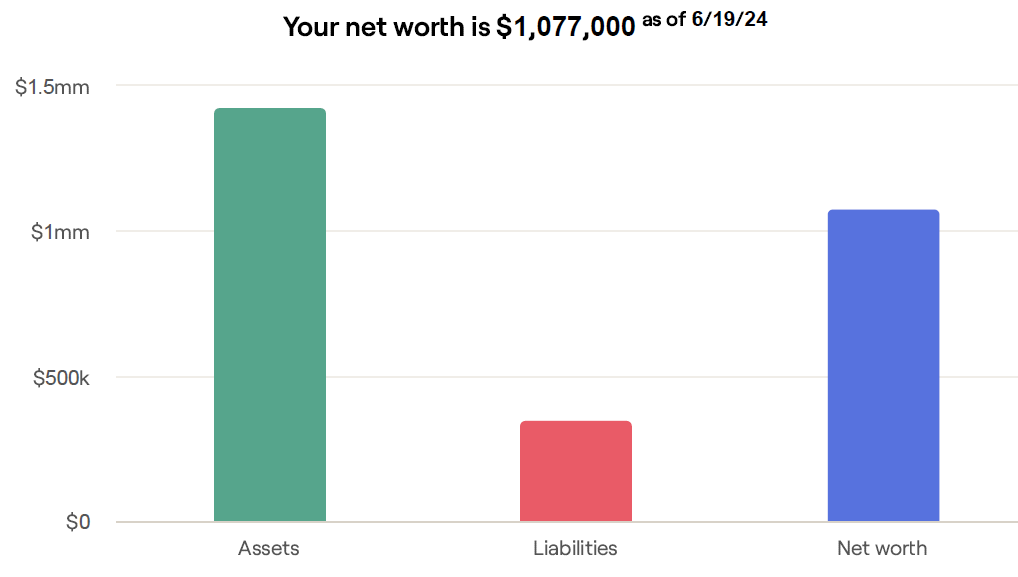

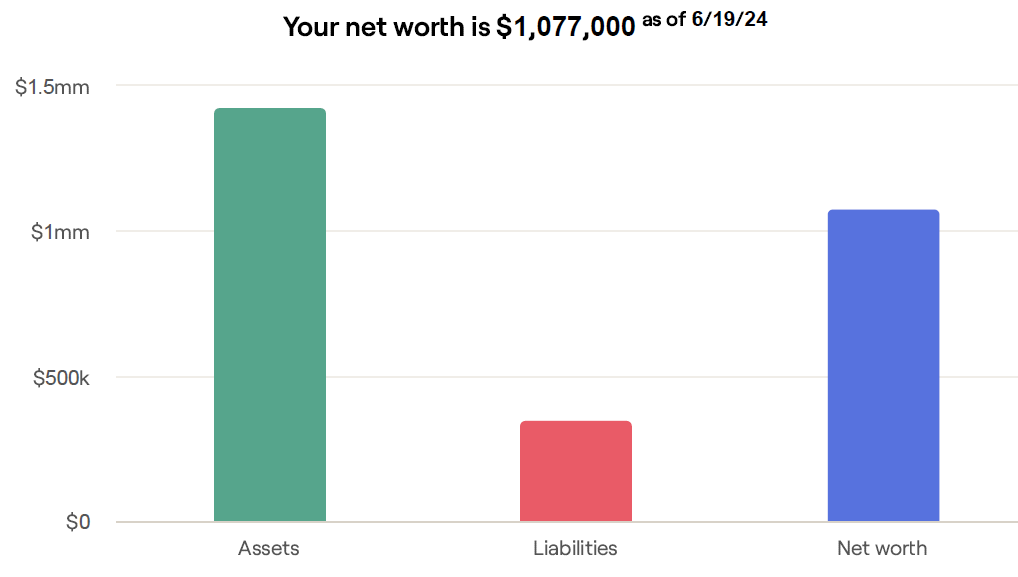

Net Worth Summary

Asset Simulation

Median Simulated Result at 67: $4,069,560

Median Simulated Result at 95: $13,901,857

Demo Financial Plan

See the full financial plan example for a 50 year old couple. Our analysis includes everything from efficient saving strategies, making sure your money works as hard as you do, to planning your dream retirement and establishing generational wealth.