Dividend Value

Portfolio Characteristics

The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule.

Warren Buffet

growth of $100 since inception

For the period ending September 30st, 2024. Inception October 31st, 2000. Data: Tradition Investment Management, S&P Global Ratings, FTSE Russell. Past performance does not guarantee or indicate future results. Please read the firm’s full performance disclosure. Assumes annual fee of 1.0%. compounded quarterly since inception. Actual fees may vary. Numbers rounded to the nearest tenth.

| Since Inception* | 20 Years | 10 Years | 5 Years | 3 Years | 1 Year | |

|---|---|---|---|---|---|---|

| Dividend Value Gross | 10.6% | 9.5% | 10.2% | 11.8% | 11.7% | 17.7% |

| Dividend Value Net | 9.5% | 8.4% | 9.2% | 10.8% | 10.6% | 16.6% |

| Russell 3000 Value | 7.6% | 8.5% | 9.2% | 10.6% | 8.7% | 27.7% |

| S&P 500 | 8.0% | 10.7% | 13.3% | 15.9% | 11.8% | 35.8% |

Projected Dividend Growth

0

%

Projected Dividend Yield

0

%

Forward (1-Year) P/E Ratio

0

x

Stocks In Portfolio

0

Return on Equity

0

%

Risk (10Y Standard Deviation)

0

%

Why Invest In A Dividend Strategy?

An Academic Approach

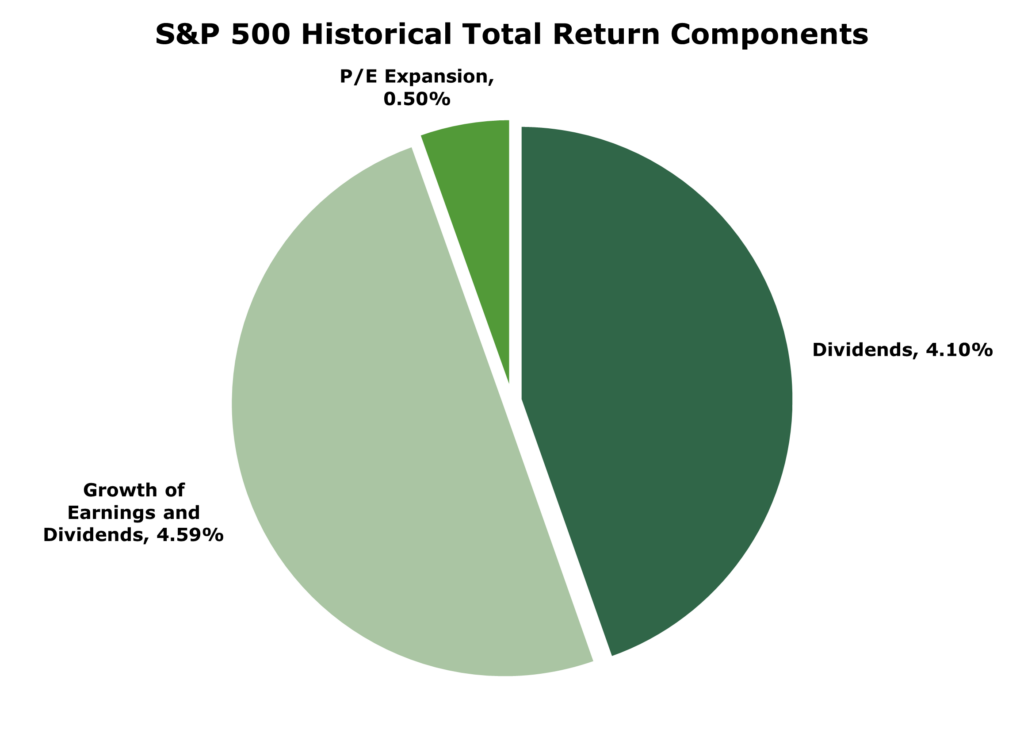

- Dividend income combined with earnings and dividend growth have accounted for approximately 95% of S&P 500’s 9.19% total return from 1910 to 2020.

- Dividends alone have accounted for approximately 45% of stock market returns.

- High-yielding portfolios provide competitive total return with downside protection, allowing you piece of mind without FOMO.

- High dividend-yields provide companies with significant incentive to protect and expand cashflows.

- Our approach has a long-term track record of above-market returns and income generation.

Translating Research Insights Into Consistent Alpha and Income

- Markets are inefficient in the short term; fear and greed create opportunities for the long-term investor.

- Share prices often fluctuate above/below their intrinsic value, providing ample selling and buying opportunities over the long term.

- The companies in this strategy feature high-yielding stocks that are growing their earnings, dividends and cashflows and trade at a discount to our estimate of their worth.

- We invest only if our proprietary research suggests a stock is undervalued, using quantitative methods developed by our founder in the 1990s.

Fact Sheet

Dividend Value's 2-page fact sheet for quick reference.

Full Presentation

Dividend Value's presentation book for 3Q24.

Firm Overview

Tradition Investment Management's firm overview sheet.