REPX Takes Advantage of Low Valuations To Build Asset Base

| Price $25.66 | Dividend Holding | May 22, 2025 |

- 5.67% Dividend Yield

- $120m pipeline project should increase realizations in New Mexico as well as unlock the potential of the newly acquired Silverback II assets.

- Power generation JV expansion to 56% of Texas field and the introduction of similar generation in New Mexico reduces costs by using low-value byproduct gas.

- 2025’s focus will be on expanding the undeveloped asset base rather than new drills while hydrocarbon prices are depressed.

- Strong balance sheet with breakeven in the mid $30 range and an estimated net debt to EBITDA of 1.3x post-acquisition close.

Investment Thesis

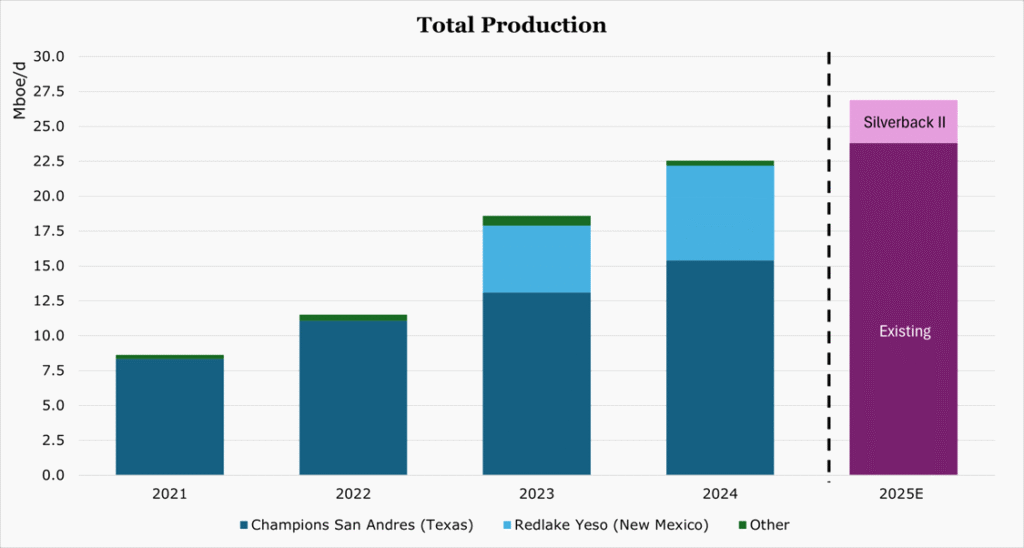

Riley Exploration Permian (REPX) is a Permian pure player, with a 60-40 oil-gas split for production. Across 78,600 acres, and a planned acquisition of an additional 47,000, REPX is guiding toward output 26.4 Mboe/d (thousand barrels of oil equivalent per day) at the midpoint or a 17.3% increase year over year.

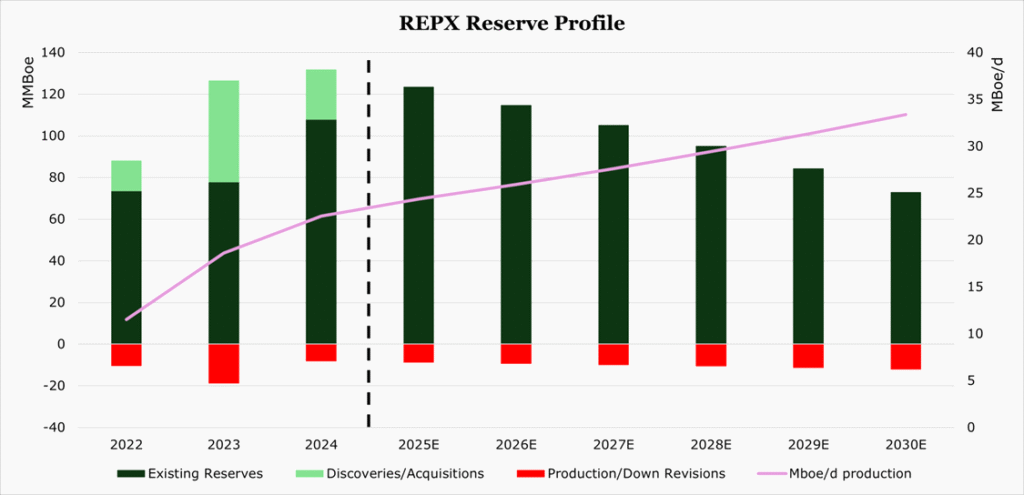

Despite volatility and lower priced crude, REPX has hedged production for 2025, which we believe will result in similar price realizations to 2024. While we expect moderation in drilling activity during 2025 due to low pricing, management will focus on building out REPX’s reserves. In the New Mexican part of the Yeso formation, REPX is building a gas takeaway pipeline connected to Targa’s midstream operations which should increase realizations over the long-term.

Despite strong free cash flow, growing production and a 4.6x P/E ratio, REPX has seen its price decline by 5.0% over the trailing twelve months. We believe that a historically strong growth in production and the focus on building out acreage in its current cost-profile, on top of a 5.7% dividend yield, provides a compelling buy for dividend investors.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY27 EPS (Earnings Per Share) times P/E (Price/EPS)

EFV = E27 EPS X P/E = $6.8 X 7.8x = $53.04

We believe that the New Mexico gas pipeline and associated 15-year gas supply deal will boost realizations in the Yeso formation, with energy JV lowering cash costs over the medium-term. Additionally, the acquisition of the Silverback II acreage in the Yeso provides strong development locations at the current cost profile. Combined, these should boost earnings power over the medium-term.

While we do expect some short term pressure from weaker pricing, REPX has 60% of oil production hedged and 85% of gas production hedged for 2025 which should provide a floor.

| E2025 | E2026 | E2027 | |

| Price-to-Sales | 1.5 | 1.4 | 1.3 |

| Price-to-Earnings | 4.1 | 3.8 | 3.6 |

SeekingAlpha Analyst Consensus

Production

During the quarter ending March 2025, production averaged 63.9% oil, 16.9% natural gas, and 19.2% NGLs (natural gas liquids) which is in line with historical averages. Revenue for the quarter ending March 2025 is 96.2% oil, 1.5% natural gas, and 2.2% NGLs which is also typical.

| Does not include Silverback II |

To improve realizations in the western part of operations, REPX is building a $120 million pipeline with 150 Mcf/d in (thousands of cubic feet per day) takeaway capacity, and an interconnection to a Targa Resources. While unnamed in the filing, REPX stated that it had also entered into a 15-year natural gas supply agreement with a ‘large-cap midstream partner’, which we also believe is Targa. The pipeline is estimated to be completed ‘before the end of 2026’ with construction beginning during the quarter ending March 2025. While we don’t expect natural gas to become a larger portion of revenue, this does unlock the ability to pump more oil. Given flaring is typically banned, the ability to take away byproducts and secure long-term buyers at positive prices is an important part of oil capacity.

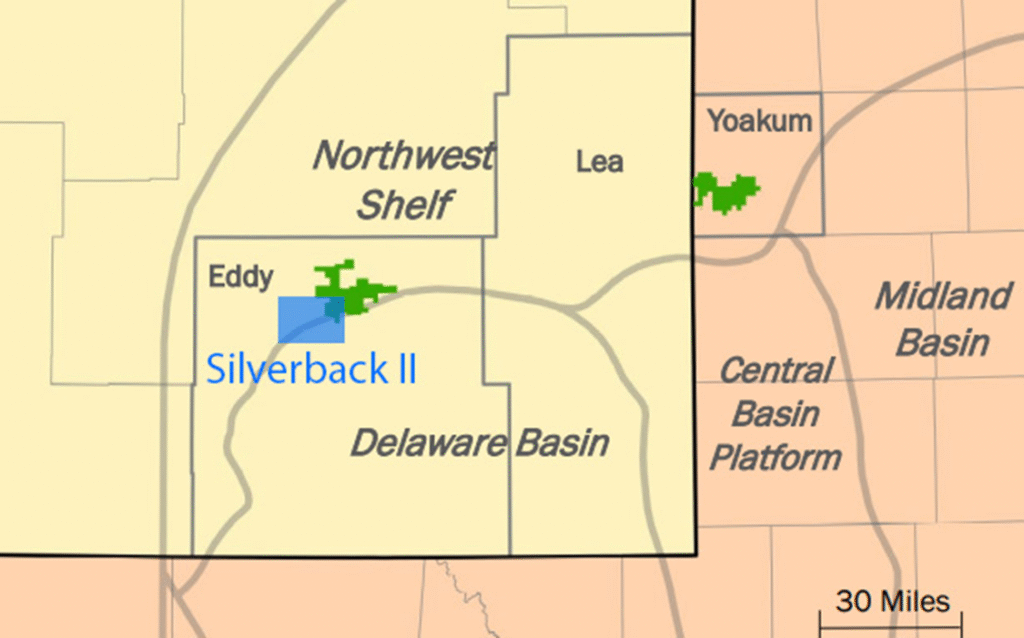

On May 3rd REPX announced it would be purchasing Silverback Exploration II for $142 million in cash. The acquisition will add 47,000 acres of 52% oil production at 5 Mboe/d at current capacity. However, drilling activity in the area has been muted by lack of infrastructure and Silverback II has not drilled a new well since 2023. The acquisition’s assets were historically ‘constrained’ by local infrastructure with REPX management stating that it believes the previously mentioned natural gas pipeline project will unlock substantial capacity. The development of the assets will initially focus on the east-end, given that production profile is ‘identical’ to the existing Yeso assets. Much of the land will flow into the undeveloped category, with long-term guidance stating more than 300 wells are believed to be viable.

Other Projects

As we briefly discussed in our previous coverage, REPX had entered a JV with Conduit Power to utilize natural gas to assist in power operations in Texas. Since our last coverage in March 2024, the amount of power supplied by the JV has grown from 36% to 56% of REPX’s power needs on the Champion San Andres field, or around 20MW.

During the earnings call, REPX revealed its plan to expand this process into the Yeso field in New Mexico. Additionally, it would be entering into “Phase 2” of the process in Texas, including increasing its ownership stake to 50% from 35% and adding 50MW of thermal generation and 50MW of battery capacity to sell into the ERCOT grid. Both projects are expected to have an in-service date of early 2026. We believe that both of these projects have the potential to add value to excess gas production, allowing for LOE (lease operating expenses) expenses to move down, especially in the more gas-rich and lower-realization parts of the Permian.

Production Outlook

REPX, inclusive of the Silverback II acquisition, expects around 10-15 net wells to come online during the year. This would be a decrease compared to 2024’s 19 net producing completions and 2023’s 18 net completions. Management did comment that it is reducing capex overall, and focusing on “the acquisition and preservation of high-quality inventory over the conversion of inventory to production”. We believe this is likely to minimize the amount of wells that reach peak capacity while prices are low.

With the addition of an additional 5 Mboe/d (thousands of barrels of oil equivalent per day) from the Silverback II acquisition, management is now guiding toward 26.4 Mboe/d in production at the midpoint.

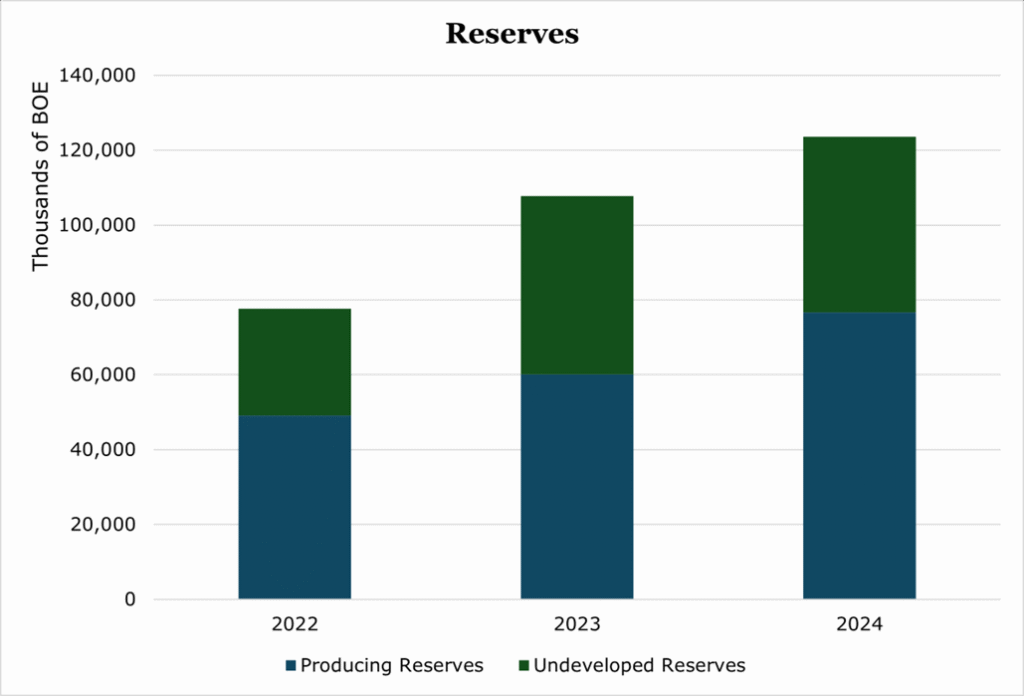

At current depletion levels REPX has approximately 10 years of reserves left, though this does not include the Silverback II acquisition as management has not provided guidance on acquired reserves. We expect the New Mexico footprint to further expand as a percentage of output over the long-term, with management stating much of the 47,000 net acres acquired are undeveloped.

Risk

Natural gas is a byproduct of Permian shale production, and we had hoped that the Matterhorn pipeline’s 2.5 Bcf/d (billions of cubic feet per day) would alleviate some pricing pressure. While some early indications appeared to suggest the discount would shrink, prices once again had 11 trading days of negative prices in Waha during March 2025 – though this was largely due to outages in compression. Through 2026, an additional 9.8 Bcf/d of midstream capacity will come online which industry analysts have warned may approach over-build territory. Despite the increase in capacity on the midstream, there are still structural limitations in downstream capacity to transport across the Gulf. For export, as highlighted by Natural Gas Intelligence, major LNG compression facilities are electric, meaning they are unable to burn-off nitrogen-heavy gas that is not typically able to be liquefied. An additional 10 Bcf of storage capacity in the area has come online at Enbridge’s Tres Palacio storage facility, though US natural gas storage levels are back at their 5-year average providing not much pressure to store additional gas.

Financials

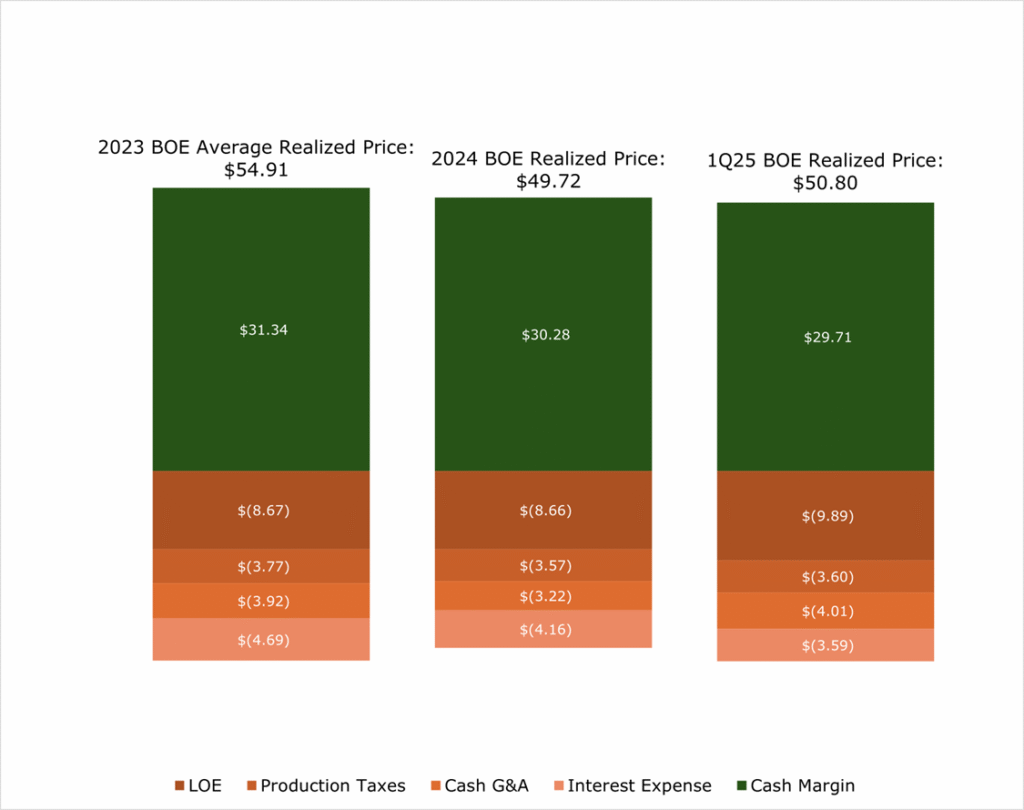

Despite depressed prices in global energy markets management had an average realized price during the quarter ending March 2025 of $50.80/boe, which we expect to come down marginally during the year as the second half of the year has lower strike prices on hedges for oil. We estimate that management has around 60% of 2025 oil production hedged, and approximately 85% of 2025 gas production hedged. This ratio will likely change when the acquisition of Silverback II closes though at this time management has not released pro-forma information on the composition of the acquisition. Typically, REPX does not hedge NGL production. For the unhedged component of production, based on the EIA spot price projections for 2025 (Oil: $66.00/bbl, Gas: $4.10/MMbtu) and REPX guidance we estimate that the spot price for 2025 will be in the low $50 per BOE range.

Management expects LOE to come down toward the historical average of around $8.66/boe through the year, with G&A (general and administrative) being marginally higher. G&A increased during the first quarter of the year due to increased headcount and legal fees from the midstream project.

For new rigs, REPX has a lower than typical cost for lateral drilling at only around $600/ft, with Midland peers clocking between $400-$1,000/ft and Delaware peers at $700-$1,300/ft. Across the full company, REPX reports its breakeven is on the lower half of peers at around $30-35/bbl.

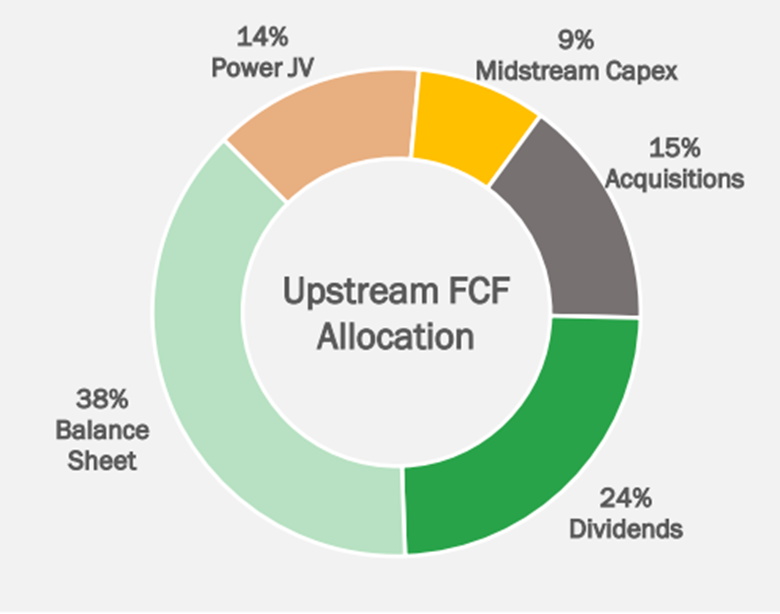

Upstream capex is expected to be $75 million at the midpoint, with 81% going toward drilling completions. The first $10 million of the New Mexico pipeline will be allocated in 2025, with the remaining $110 million for 2026. The power JV will be getting $15 million in capex to begin construction on the 50MW ERCOT project and the New Mexico expansion. Overall, capex is expected to be $110 million in total, or around a 15.4% drop since 2024.

During 2024 management reinvested 44% of cash from operations into exploration and production operations, with 56% being converted into “upstream free cash” and 35% being converted into free cash flow.

Even with the acquisition, we believe the dividend is more than safe. REPX currently has a dividend yield of 5.7% and a free cash coverage ratio of 3.7x. During 2024, REPX generated $116.4 million in free cash flow, or about $5.30 per share.

As of the quarter ending March 2025, REPX had a trailing twelve-month net debt to EBITDA of 0.9x. Due to the Silverback II acquisition we believe this number could climb as high as 1.3x – though the specific financing terms of the acquisition are not yet public.

REPX maintains a borrowing capacity of $400 million. Over the medium term, the new producing assets could potentially allow for a larger borrowing capacity and therefore larger acquisitions in the future. As previously discussed, we expect additional acquisitions during the medium term, with management focusing on tucking-in undeveloped reserves. While 2023 saw a substantial number of private-equity exits from the Permian at high values, there are still a number of smaller assets that lack experienced operators in areas with lower realizations and poor infrastructure like the western Permian. With the addition of the New Mexico gas pipeline and a long-term supply deal, we believe that REPX is in an excellent position to consolidate more Yeso operators.

Conclusion

Despite management cutting capex and targeting fewer well completions in 2025, production is still expected to climb by 17.3% year over year which should boost revenues despite softer realizations. Despite these softer realizations through 2026, REPX has a mid-$30 breakeven, which may come down even further as power projects begin to reduce cash costs.

On the acquisition side, the strategy appears to be concentrated on acquiring assets that private operators are no longer able to feasibly operate with a lack of infrastructure which should create favorable valuations for REPX, and strong earnings power once the New Mexico gas pipeline comes online.

While the acquisitions will increase the debt burden, we believe that its low-cost and high-productivity wells should provide for a fast repayment back below the 1.0x debt to EBITDA range. Management has a strong focus on shareholder returns with a 5.7% dividend yield and strong free cash conversion; thus we believe that REPX is an attractive stock for dividend investors in the short-term with potential for capital appreciation over the long term.

Peer Comparisons