Economic and Market Review October 2024

October 31, 2024

| Equity Indices | YTD Return |

| Dow Jones | 11.07% |

| S&P500 | 20.56% |

| NASDAQ | 22.65% |

| MSCI – Europe | 13.41% |

| MSCI–Emerging | 16.86% |

| Bonds (Yield) | |

| 2yr Treasury | 4.16% |

| 10yr Treasury | 4.27% |

| 10yr Municipal | 3.04% |

| U.S. Corporate | 5.15% |

| Commodities | |

| Gold | $2,745.97/oz |

| Silver | $32.77/oz |

| Crude Oil (WTI) | $70.11/bbl |

| Natural Gas | $2.71/MMBtu |

| Currencies | |

| USD/CAD | $0.72 |

| USD/GBP | $1.29 |

| USD/JPY | ¥152.05 |

| USD/EUR | $1.09 |

Overview

Real GDP growth came in at 2.8% year over year, with inflation moderating to 2.4% year over year, though food and shelter were still elevated.

Real disposable income rose once again for the quarter ending September 2024, the 27th straight monthly rise and the longest streak since record keeping began in 1959. However, the savings rate remains at near record-lows at just 5% compared to the long-term average of 8%.

US Job openings fell by 420,000 in September to 7.44 million, the lowest level since January 2021. Layoffs also increased by 160,000 in September to 1.83 million, the highest level since 2020. The ratio of job vacancies to unemployed workers fell to just 1.1x, below the 2019 average of 1.2x. Labor participation has begun to recover, moving up to 62.7% of US residents 16 and over during 2024, compared to the pre-pandemic average of 63% and the pandemic low of 60.1%.

Equities overall have been shaky on increasing Treasury yields and presidential election-driven volatility. Still, despite the late-in-the-month sell off caused by muted mega cap guidance, this October was the best presidential election year for stocks since 1936.

Auto Loans are Underwater

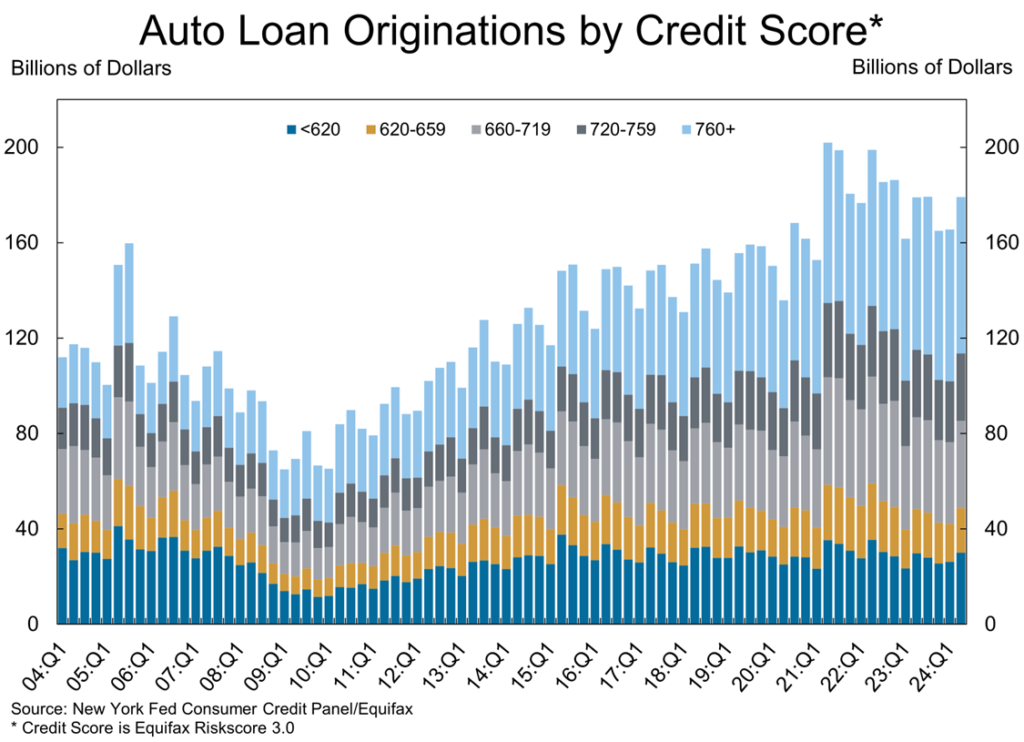

More than 31 million auto loan accounts registered with the Consumer Financial Protection Bureau, or about 33%, owe more than their vehicle is worth. With supply chains choked in 2022, the price of new and used vehicles reached record highs, driving a record number of auto-loan originations.

| Quarter ending September 2023 | Quarter ending September 2024 | |||

| New Cars | Used Cars | New Cars | Used Cars | |

| Term (Months) | 68.4 | 70.1 | 68.8 | 69.5 |

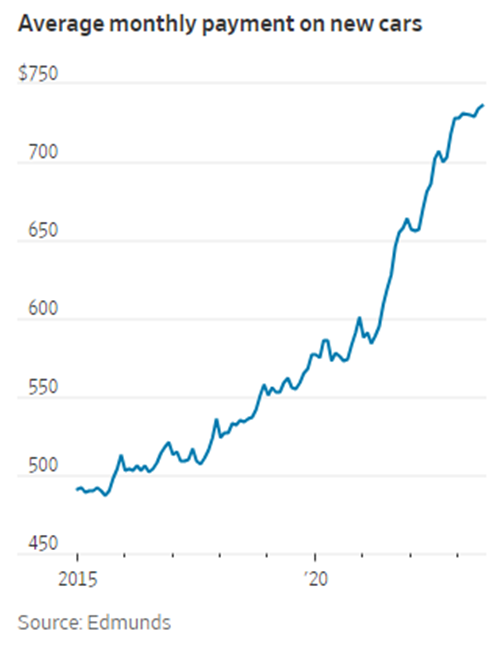

| Monthly Payment | $736 | $567 | $736 | $548 |

| Amount | $40,713 | $29,328 | $40,149 | $28,097 |

| APR | 7.1% | 11.2% | 7.4% | 11.3% |

While dealer inventories have improved, financing terms have gotten more extended to make up for rate increases. Now, 17.4% of auto loan holders have a car payment over $1000 per month. The high payment on the traditional 36- or 60-month loan has driven many to choose much longer loan periods. A record high 18.1% of new auto loans are now 84-month terms.

For the quarter ending September 2024, 24.2% of Americans who traded in a vehicle had negative equity, which is still below the 2019 figure of 34%. However, the amount of negative equity owed has hit a record high, with the average trade in owing $6,458.

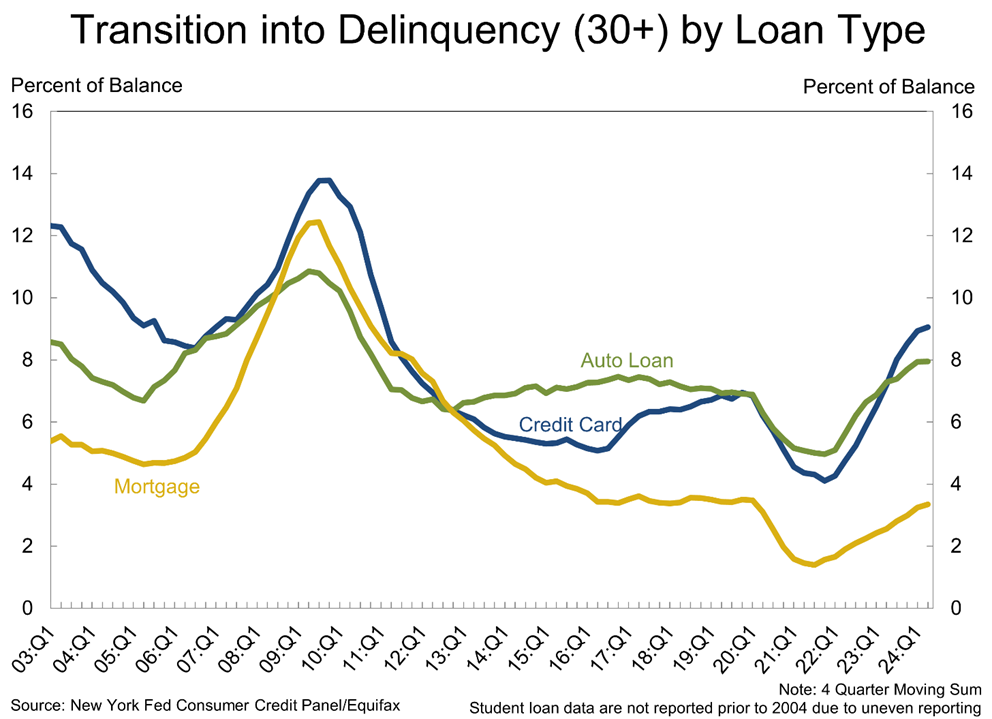

Auto defaults have reached delinquency levels not seen since the global financial crisis, with Ally Financial the largest holder of auto-loan debt in the US, stating that delinquencies came in 20bps above expectations for the quarter ending September 2024.

Record Deficit and Trouble on the Horizon for Treasuries

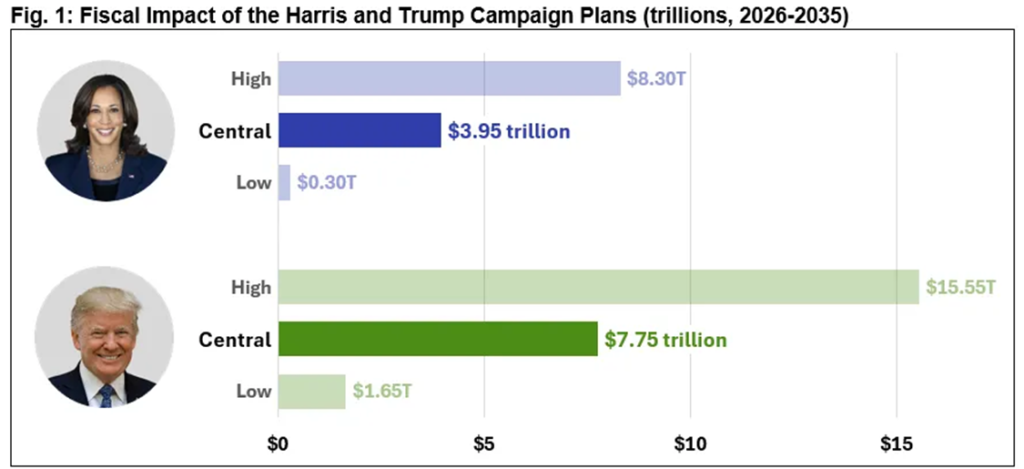

According to the nonpartisan Committee for a Responsible Federal Budget, both candidates have economic plans that include massive deficit spending, a fact that has begun to impact Treasury markets.

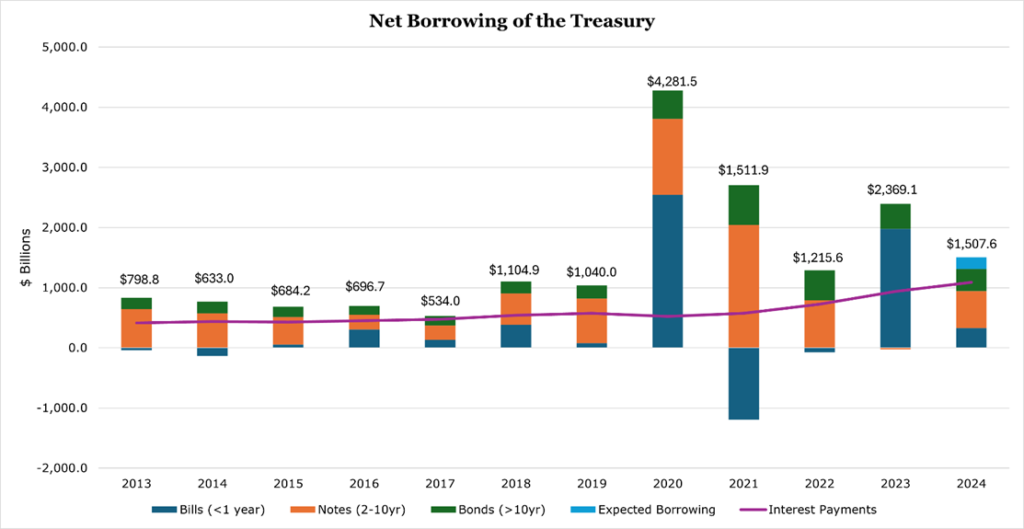

Overall, Treasury markets have begun to doubt how much longer the government can avoid a substantial ramp in borrowing, with a $1.85 trillion deficit and interest payments alone hitting more than $1 trillion per year. The Department of the Treasury maintains that it will keep auction sizes ‘as-is’ for ‘at least the next several quarters’ in the face of muted demand. It is important to note that ‘as-is’ is still a gross issuance $564 billion (net $195 billion) for the remainder of 2024.

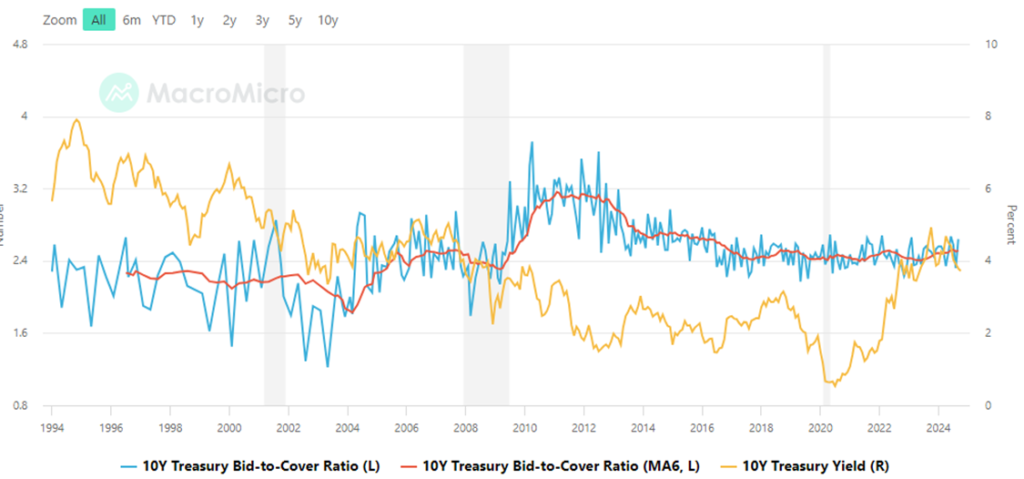

As discussed last month, the main metric to watch to see if the Treasury is issuing debt at a rate faster than the market wants is the bid-to-cover. Any ratio over 1.0x indicates that there are more buyers than sellers in the market. However, as primary Treasury dealers (like investment banks) are obligated to buy whatever the Treasury is selling, any ratio approaching 1.0 would be detrimental to the financial system.

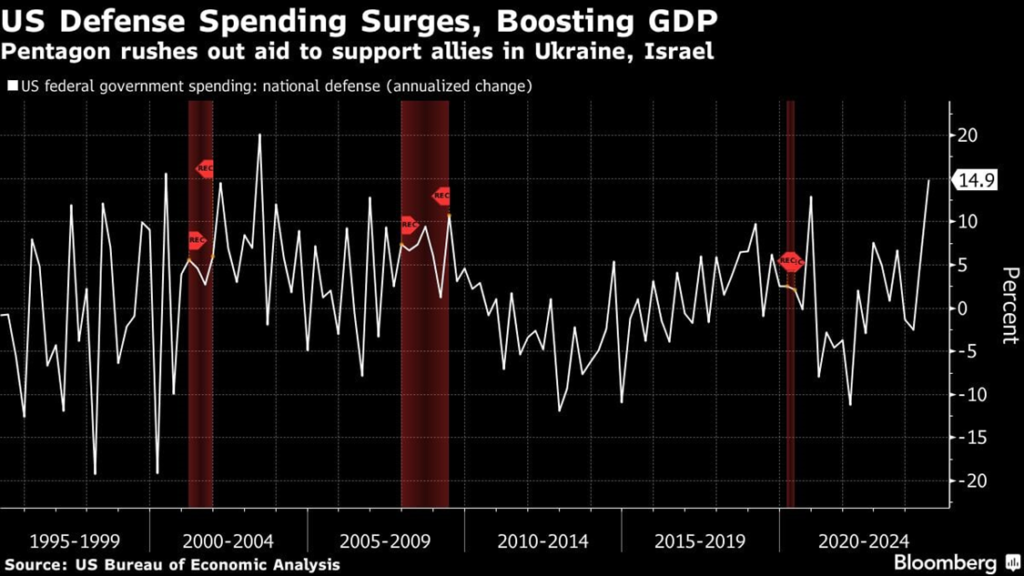

Currently, government spending as a percentage of GDP has grown to 18%, up 90bps since the quarter ending September 2023. Since the Global Financial Crisis in 2008, the percentage of government spending to GDP has steadily increased.

With defense spending on the rise to the highest level since the invasion of Iraq in 2003, it could be on pace to continue to climb above this figure well into the future.

Despite Rate Cuts, the Long End of the Curve Expects More Inflation

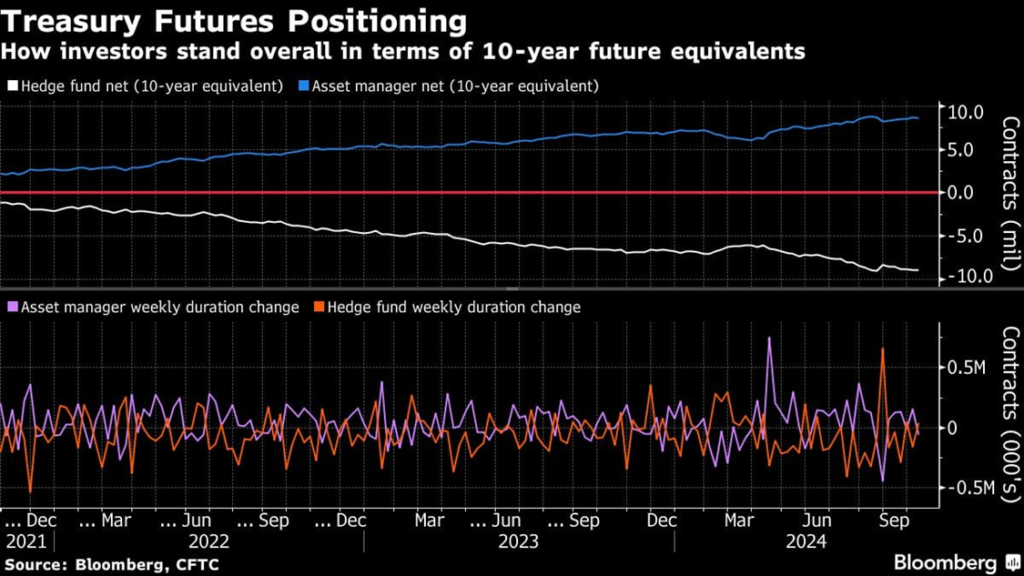

Inevitably, more deficit spending has led to the beginnings of the sentiment that the Treasury may struggle in the future to pay off their ballooning debt, or that there will be more inflation on the way. Either way the sentiment is something must give, as a result, hedge funds have built up the most aggressive short position of Treasuries in history.

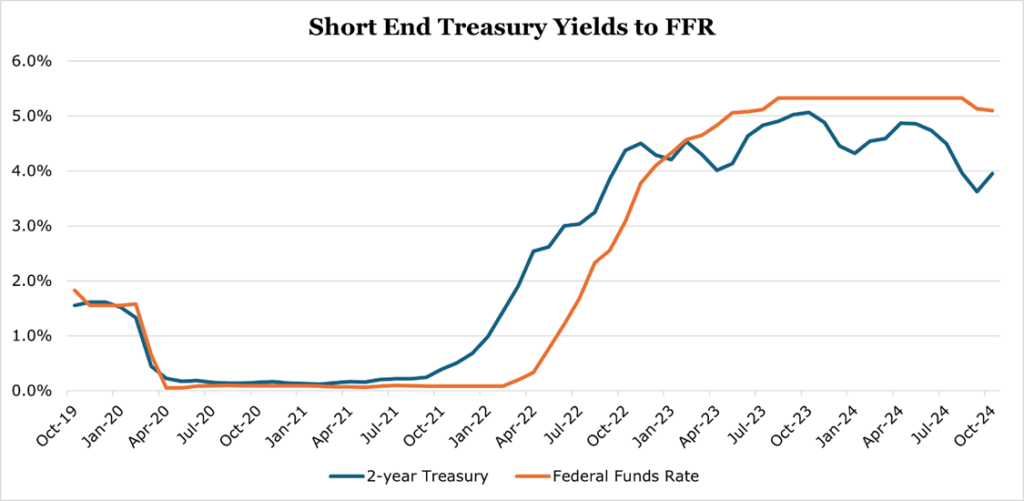

Typically, short-term Treasury market yields are dictated more by expectations of rate changes rather than the actual Federal Funds Rate. As investors expect rates to go up, yields go up – often months ahead of actual rate decisions.

Since October 2023, Treasuries had priced in moderate rate cuts on the horizon. In September 2024 when the Fed began with a 50bps cut, rates tumbled for a brief time.

Over the past month, however, rates have steadily creeped back up to 4.25% for the 10-year, and 4.11% on the 2-year. While part of the jump can certainly be attributed to presidential-election-jitters, it is more likely that the market is beginning to price in fewer rate cuts on the horizon.

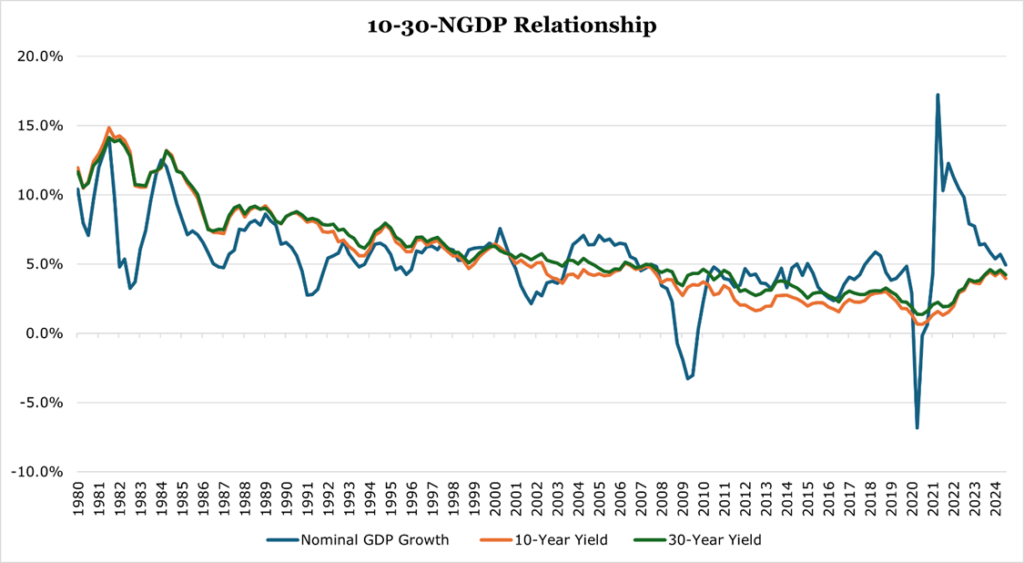

The long end of the curve is traditionally dictated by a mixture of long-term inflation and long-term GDP expectations. Thus, the long end of the curve should track nominal GDP closely. Since 2008 the relationship has been much weaker, especially on the 10 year, and since 2020 it has not existed.

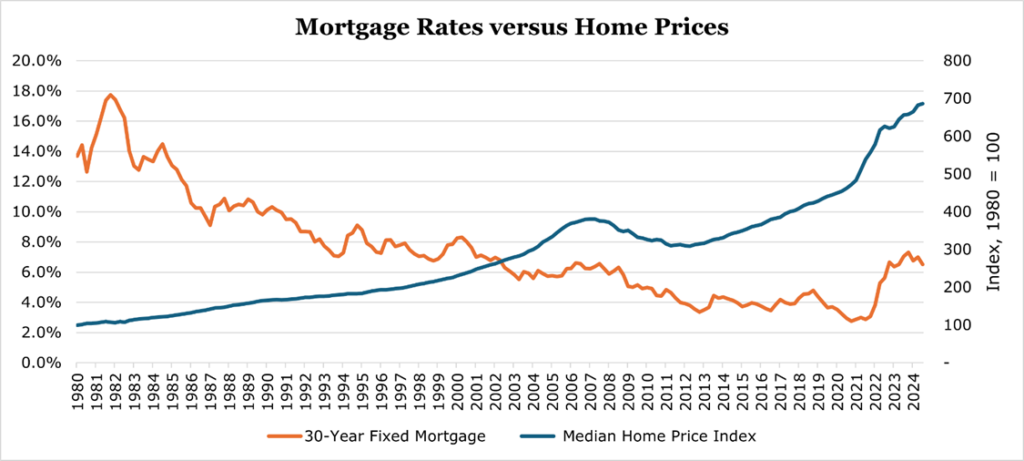

For consumers, despite the rate cut, the long-term expectation of higher average inflation and lower non-government GDP means mortgage and longer-term borrowing rates will stay higher.

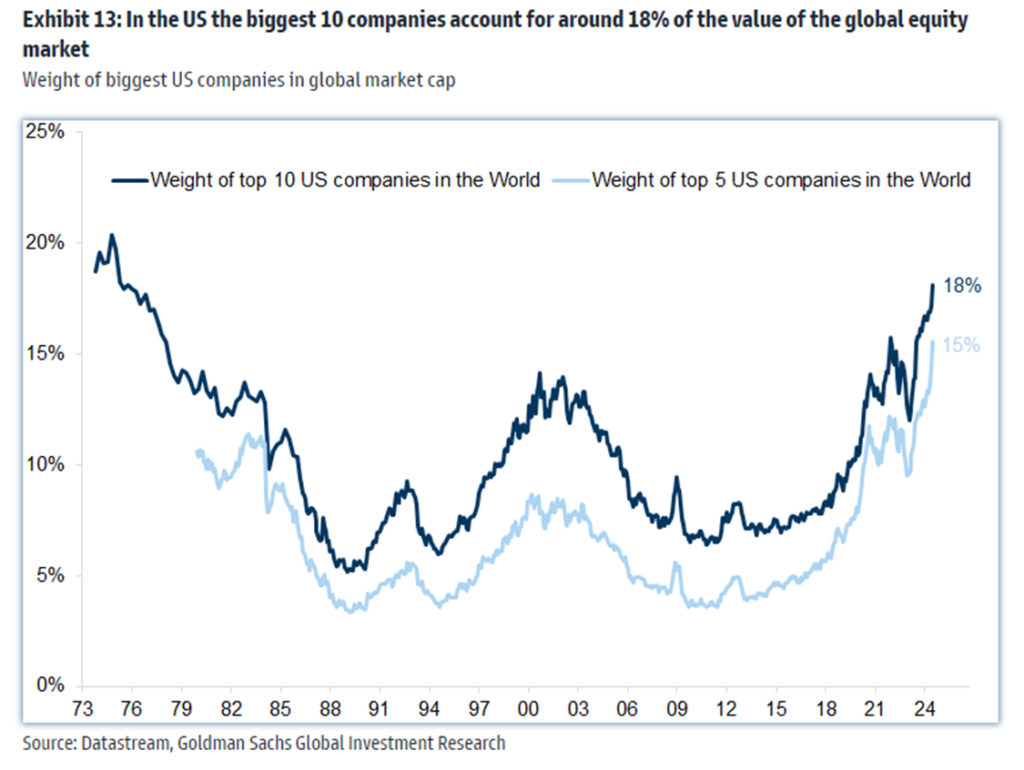

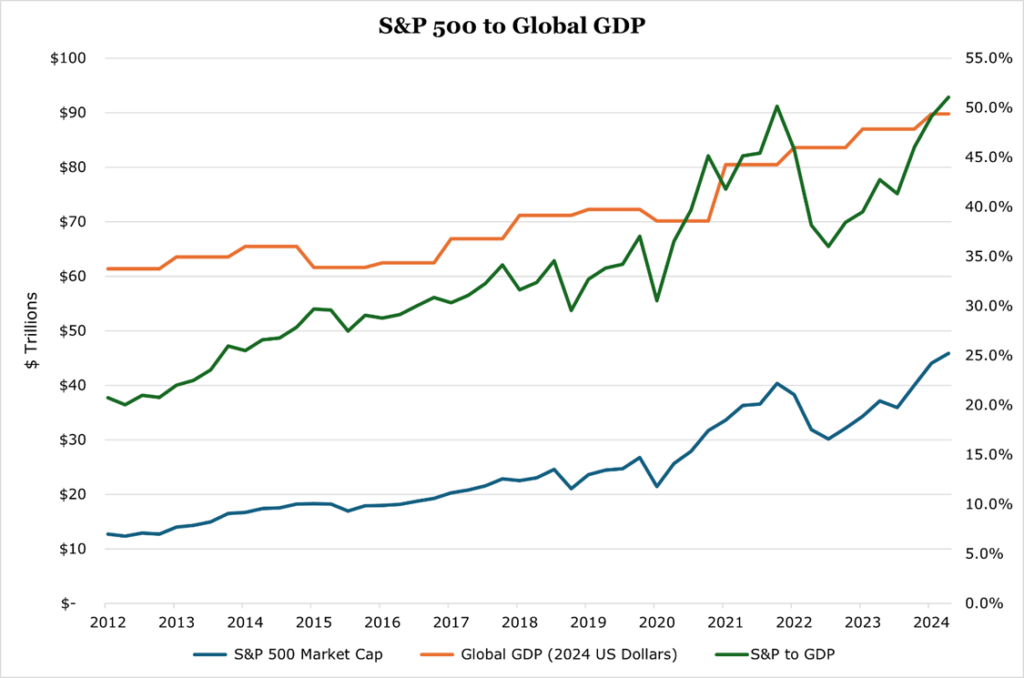

Equities Continue to Post Global Concentration Risk

The top 10 US companies now account for 18% of global stock market capitalization, with NVIDIA alone being bigger than the market cap of 5 individual G7 counties. At the end of 2023, the S&P 500 was the same value as 46% of global GDP. Based on a global growth projection of 3.2% by the IMF, the value could climb to 51.1% of GDP by the end of the year.

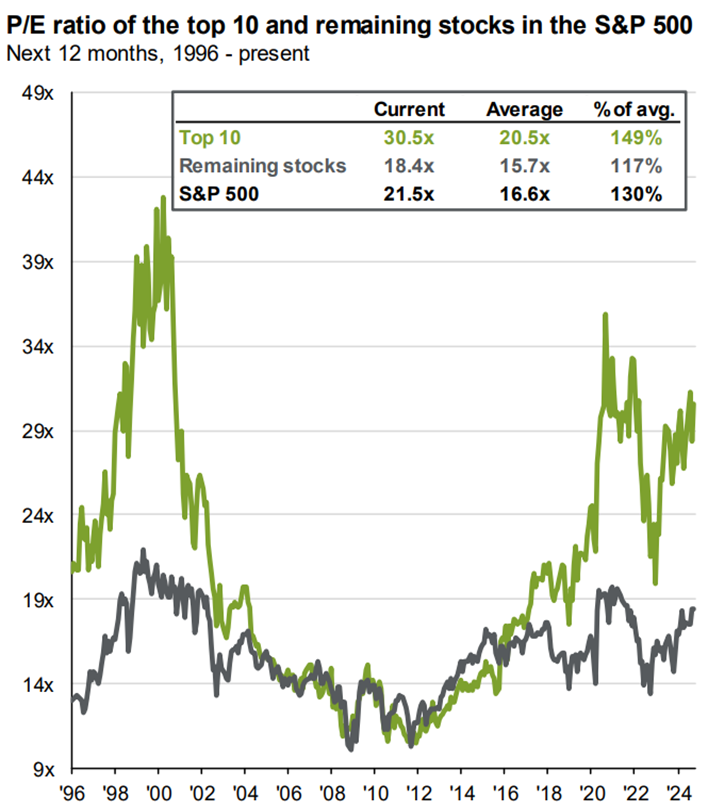

While stocks delivered above average earnings growth in 2024, 9.4% compared to the long-term average since 2001 of 7.5%, valuations have increased 130% above their average. The top 7 stocks in the S&P 500 made up 45% of returns on a YTD basis.

Equally, the high earnings expectations have begun to weigh. For the quarter ending September 2024, 75% of companies beat EPS estimates which is in line with the 10 year average. However, those surprises are getting smaller, with companies reporting earnings 5.7% above estimates – below the 10-year average of 6.8%.

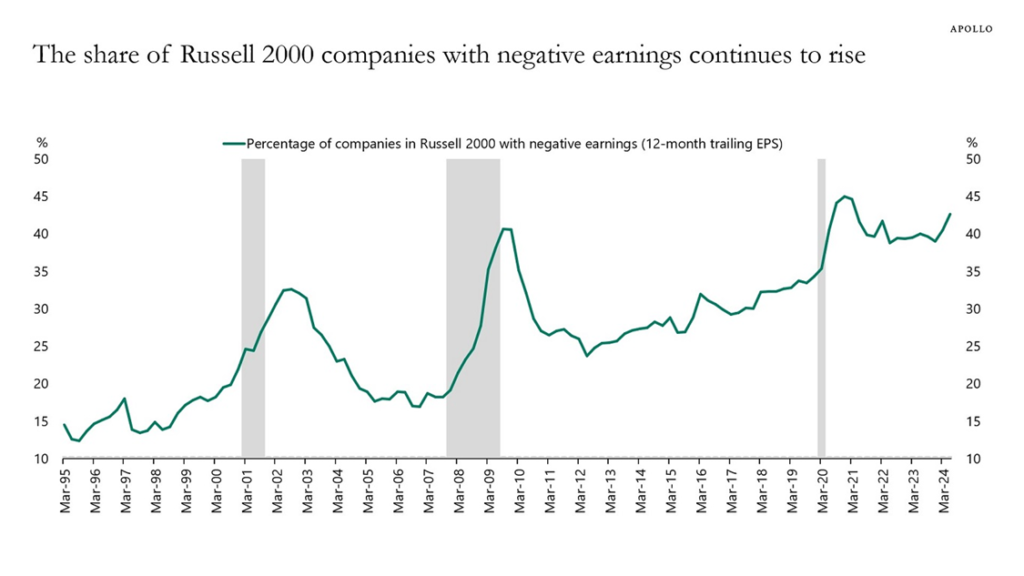

Outside of the S&P 500, almost 50% of companies in the Russel 2000, the small-cap US benchmark, have negative earnings. The Russell midcap index has 14% of companies with negative earnings. Households in the US hold 40.7% of US equity values, with 58% of households reporting some equity exposure, both record highs. A substantial correction would cause severe ripple effects through the entire economy.