Economic and Market Review January 2025

anuary 31, 2025

| Equity Indices | YTD Return |

| Dow Jones | 4.24% |

| S&P500 | 1.65% |

| NASDAQ | 0.03% |

| MSCI – Europe | 6.90% |

| MSCI–Emerging | 1.81% |

| Bonds (Yield) | |

| 2yr Treasury | 4.24% |

| 10yr Treasury | 4.51% |

| 10yr Municipal | 3.06% |

| U.S. Corporate | 5.35% |

| Commodities | |

| Gold | $2,783.59/oz |

| Silver | $30.95/oz |

| Crude Oil (WTI) | $73.94/bbl |

| Natural Gas | $3.304/MMBtu |

| Currencies | |

| CAD/USD | $0.68 |

| GBP/USD | $1.23 |

| USD/JPY | ¥155.50 |

| EUR/USD | $1.02 |

Overview

A popular theory among traders is that US stocks rise higher in January than in other months. Appropriately deemed the January Effect, the effect is typically explained by traders entering position after tax-loss selling has completed, but over the last decade the effect has lost much of its visibility. Similarly, if stocks rise in January, the year will end positively in 85% of cases.

US stocks had a volatile start to January, with the Fed raising long-term inflation targets, Trump following through on tariffs, and disruptions in the tech industry. The S&P was buoyed by consumer spending coming in above expectations with inflation coming in at expectations.

Oil prices peaked in the middle of the month at $78.71 following stronger industrial demand signals from China and the US but quickly pulled back over a stronger US dollar and the expectation that US production would increase. Natural gas supplies being lower than expected coupled with a projected year-end demand growth of 2.5% have sent European prices up more than 13.7%. US prices slumped briefly toward the end of the month with the EIA reporting above-average storage withdrawal but quickly rebounded more than 8.2% following 10% tariffs on Canadian and Mexican oil products.

Tumultuous Tariffs

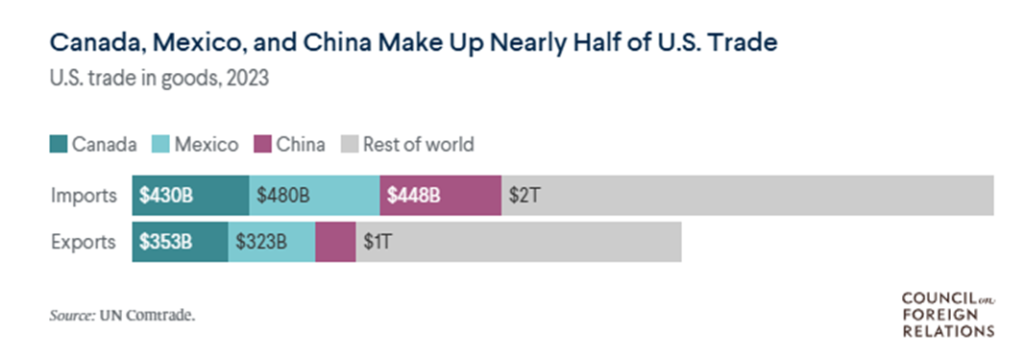

On January 31st, Trump stated that a 10% tariff on all Chinese goods and a 25% tariff would be applied to all Mexican and Canadian goods starting February 3rd. The exception is Canadian oil will only be tariffed at 10%. However, a deal has been reached with Mexico to suspend the tariffs, and we expect a similar deal to be made with Canada in the near future.

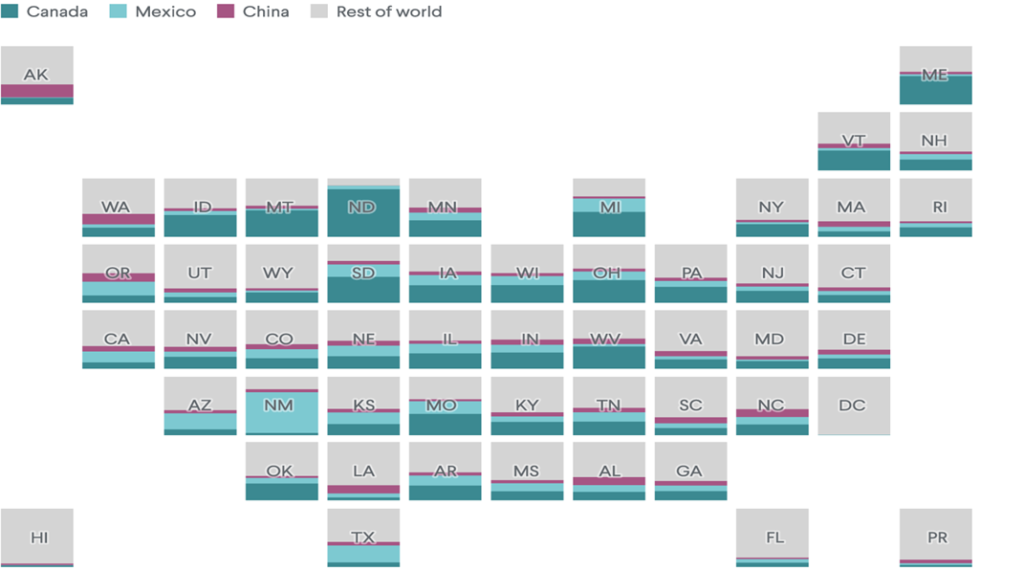

While the US relies less on trade than its peers, the tariffs on China, Canada and Mexico would likely impact more than 11% of US GDP. The cost to consumers will undoubtedly be high, with the US importing $1.4 trillion from the 3 named annually, including almost $100 billion in agricultural products and over 90% of fertilizer products used in domestic crop production. Deutsche Bank economists quoted in Reuters state that the tariffs would raise inflation by around 100bps to 3.7% by the end of 2025 with annual real GDP growth falling by a similar 80-100bps. The economies of Canada and Mexico are likely to be hardest hit, with the Bank of Canada stating that broad tariffs would contract the economy by 6%, with Mexico’s falling as much as 12%.

Geographically, analysts estimate that the impacts would be hardest felt in the US Midwest and Southwest. Gas prices in the Midwest could rise by as much as $0.50/gallon, with as much as 70% of Canadian oil imports refined in and around the PADD2 region of refineries in the Midwest. Mexico purchases over 70% of New Mexico’s produced goods, with Texas sending billions of semiconductors to Mexican automotive production plants.

This is provided there are no counter-duties imposed. Both Mexico and Canada have stated that any tariff on their goods into the United States would be met with a harsh reply. Trump has stated that later in February more tariffs would come, this time targeted at the EU, and global tariffs on semiconductors, prescription drugs, aluminum, copper and oil.

Rolling Over Treasuries Could Pose a Threat to Market Stability

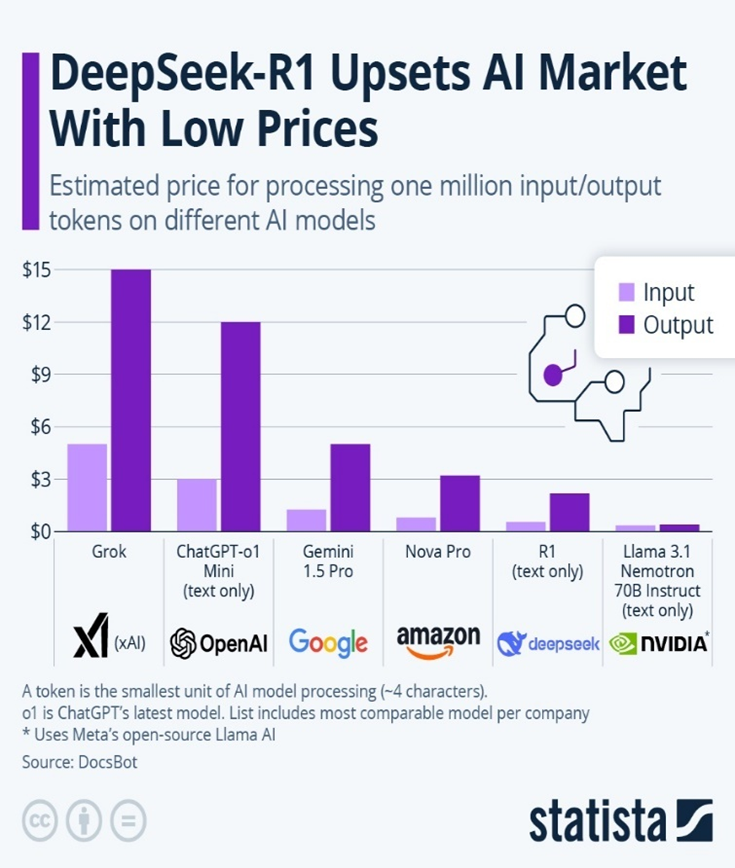

Chinese open-source AI Model DeepSeek R1 became the talk of Wall Street in the week of January 20th, reporting that it only took $6 million to train. DeepSeek R1 costs less than half of OpenAI’s ChatGPT to maintain at an enterprise scale while performance benchmarks indicate it is equivalent to OpenAI’s newest O1 model.

However, analysts have stated the $6 million figure is likely misleading, with DeepSeek believed to have used $500 million in chips either smuggled into China via Singapore, or purchased before US export controls came into effect in 2022. While this is far above the reported figure, it is still cheaper than ChatGPT, which cost an estimated $1 billion to train.

However it was achieved, the market saw its third worst day in two years, with the NASDAQ falling 3.5%. NVDA remained down 12.8% since the release of DeepSeek through the end of January.

In December 2024, the Chinese antitrust regulator announced it would be investigating NVDA for unfair monopolistic practices with fines as high as $1 billion, a move widely seen as retaliation for continued US restrictions on chip exports to China. On January 30th, the Department of Commerce announced that it was beginning an investigation into the allegations of illegal importing with the end result potentially being further restrictions on NVDA exports or fines.

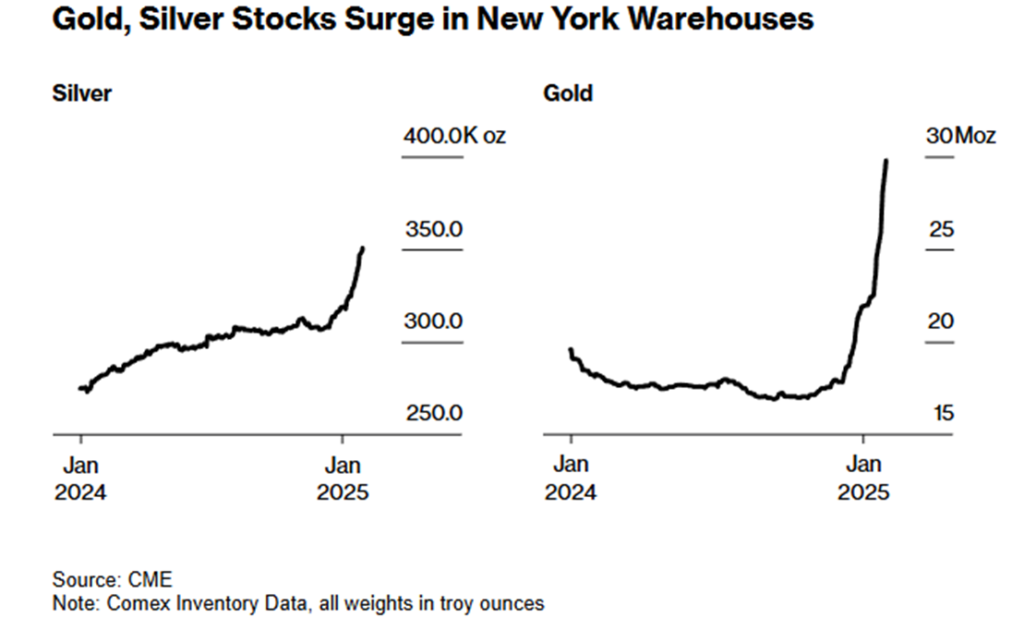

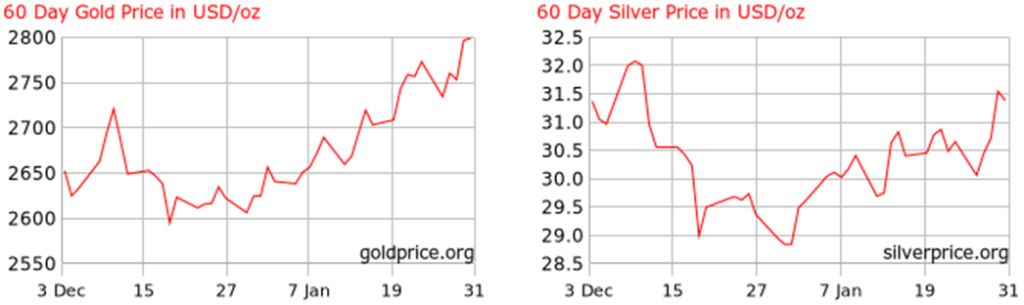

Tariffs Sends Precious Metals Higher, Alternatives Lower

Since the election precious metals traders have been moving gold and silver to the United States at pace not seen since the early pandemic. The Bank of England reported lead times for physical delivery of bullion up to 5 weeks instead of the typical 3 days.

Traders seeking to enter the market before tariffs have driven gold to another all-time high and silver to a 10 year high, with delivery volumes the second highest since data recording started in 1994.

The move to safety in gold and other hard assets has seen crypto markets pull back from all time highs following Trump’s election, with Bitcoin down 8.68% since January 27th.

Meme-coins saw a route following the announcement of tariffs, with CoinMarketCap.com’s composite of the top meme-coins falling 22.1% while volumes spiked by 136.0%.

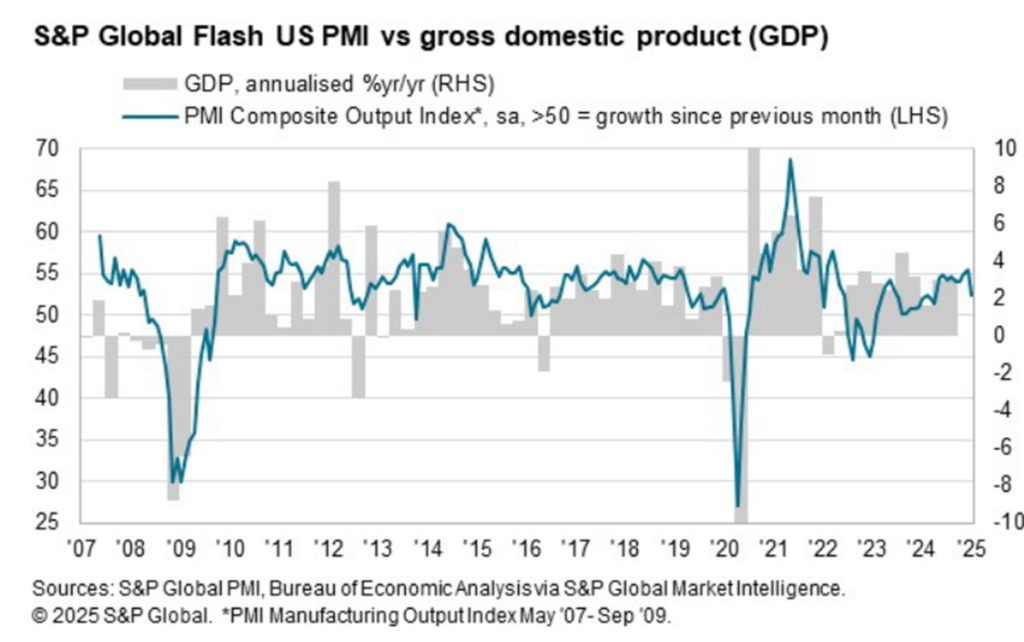

Industrial Activity Up in the US, Though Services Slow

US PMI (Purchasing Manager’s Index) came in at 52.4 during January 2025, lower than December’s 55.4. Largely the decline was driven by inflation hitting 4-month highs reducing service demand. However, the manufacturing component of the index beat market expectations in January coming in at 50.1, compared to expectations of 49.7. According to S&P, this was due to manufacturing optimism about the new administration focusing on growing domestic capacity and continued ability to pass on higher-costs to consumers.

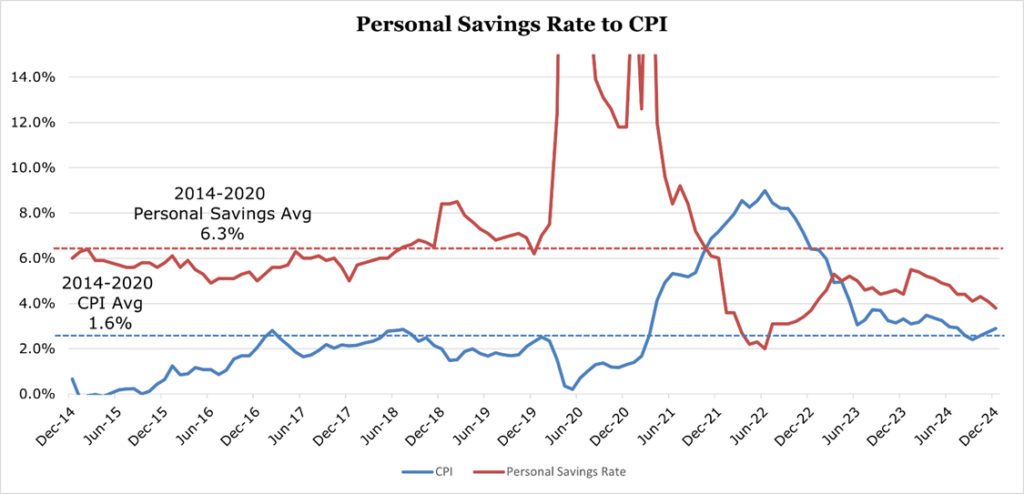

Core inflation remained at 2.8% for the third month in a row and has shown no improvement since May 2024. Total inflation accelerated by 16bps to 2.9%%, driven by holiday spending and a 30bps drop in the savings rate. Pre-pandemic, the average American saved 6.3% of their disposable (post-tax, post-expenses) income. Currently, the average American saves just 3.8% of their disposable income.

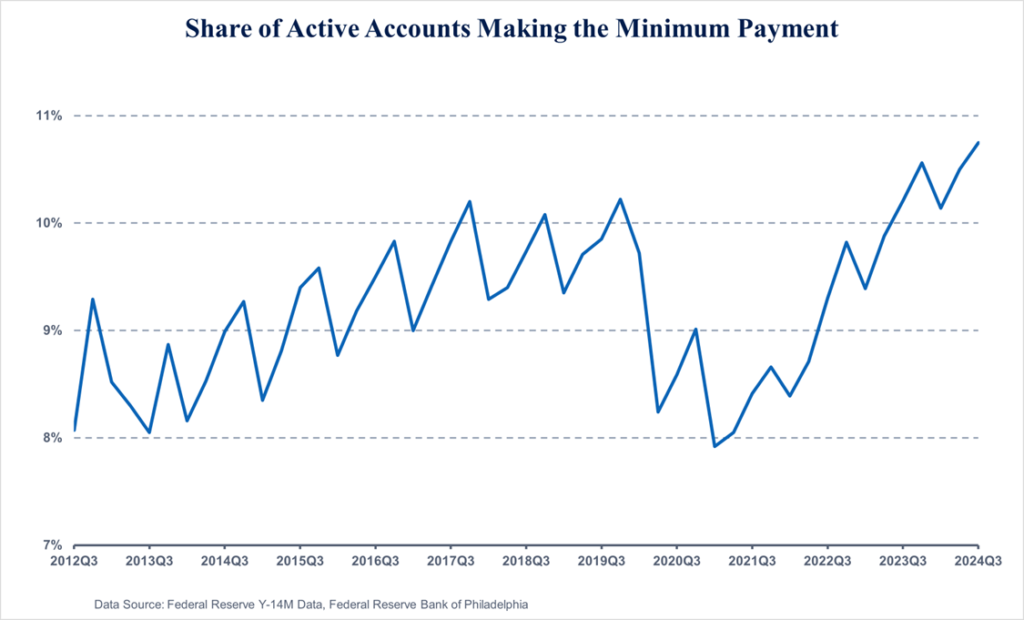

According to the Philadelphia Fed, credit cards also boosted spending significantly. The percentage of consumers only making the minimum payment on their balance has reached 11%, a record high since data keeping began.

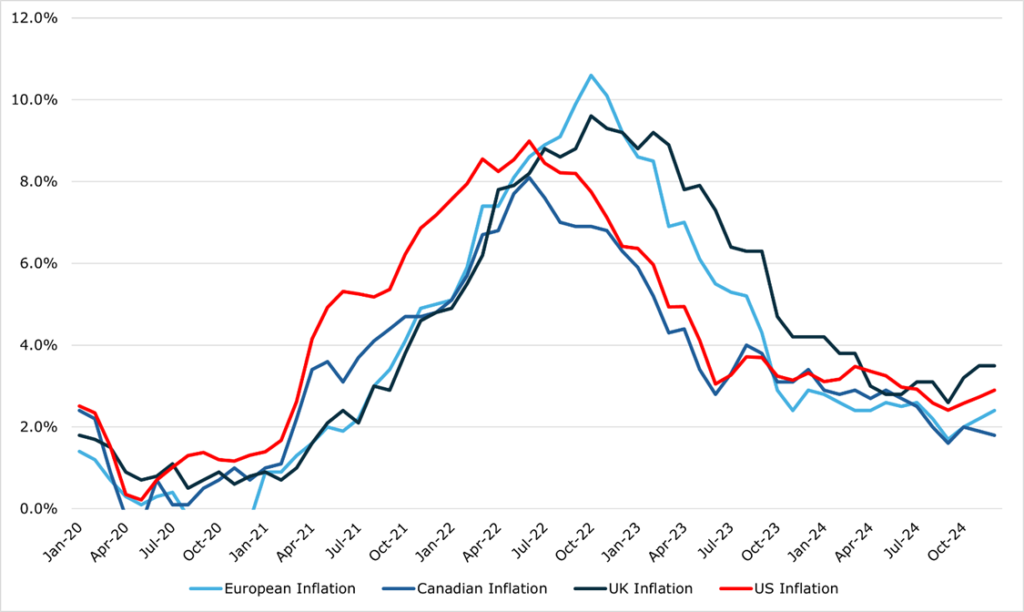

Global Inflation is Moderating, Cutting Cycle in Full Swing

Within the developing world, the UK and US continue to struggle with inflation, while Canada and the Eurozone have seen inflation fall back down to the 2.0% target. In the US, as we have discussed before, much of the inflation remaining is due to resilient consumer spending. In the UK rising housing prices coupled with an unstable energy market due to the 2022 Russian invasion of Ukraine have kept consumers under stress.

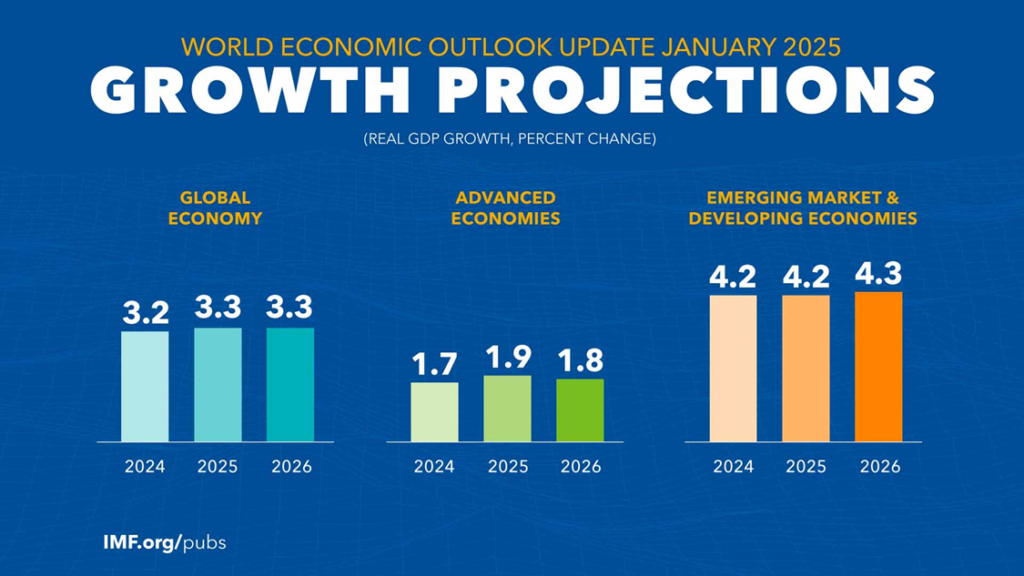

The International Monetary Fund has called the 2025 economic outlook “divergent and uncertain”. Global GDP growth is projected at 3.3% for both 2025 and 2026, below the historical 3.7% average. Largely, this down revision is due to continued and persistent weakness in the Chinese economy, with stimulus thus far unable to induce a comeback. Additionally, a strong US dollar with high US interest rates has kept most capital within the United States, tapering expectations for Eurozone growth.

Global Inflation is Moderating, Cutting Cycle in Full Swing

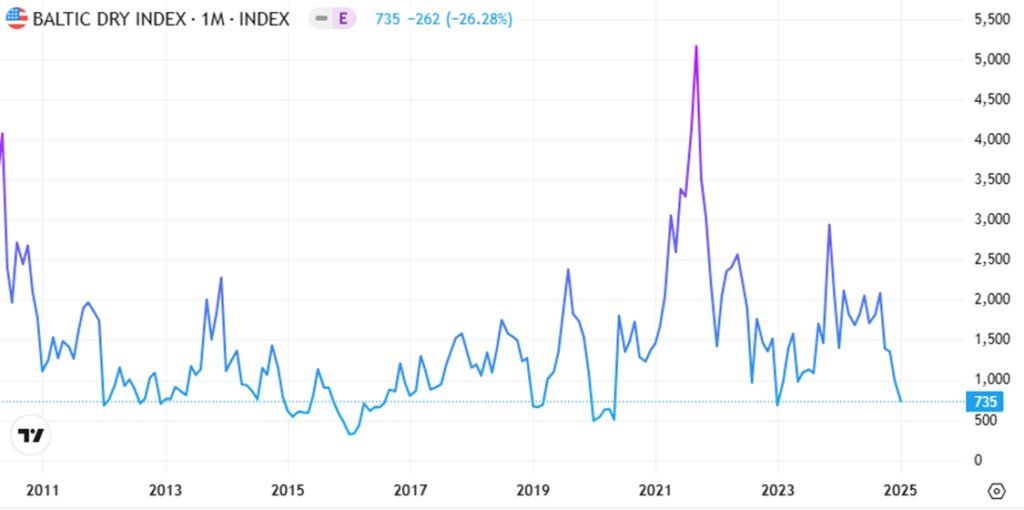

The Baltic Dry Index (BDI) is the weighted average weight of dry bulk cargo like raw materials. Since the start of 2025, the index has fallen 25%, hitting 23-month lows. Certain components of the index, like Panamax freighters, hit their lowest point since June 2020.

The BDI is an important signal for industrial activity. Raw material shipping activity is typically muted in the weeks leading up to Chinese New Year. Over the rest of the year, the Houthis stepping back attacks on shipping could release more capacity into the market and drive rates further down. With shippers uncertain of Chinese demand recovery in 2025 and pessimistic about US import activity, it could be the beginning of a cyclical bottom for shipping.