Wiser Diversification

Intelligent Construction

The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule.

Warren Buffet

These graphs are for illustrative purposes only to show possible return profiles of various asset classes. Tradition does not make any assertions, estimates, or guarantees about future results. Future results are unpredictable and could result in losses. Expected returns and standard-deviations are not forecasts or guarantees and are merely reasonable long-term goals for diversified strategies. Actual results could vary materially from these expected long-term returns and standard-deviations and could result in losses. Please see our full disclosure.

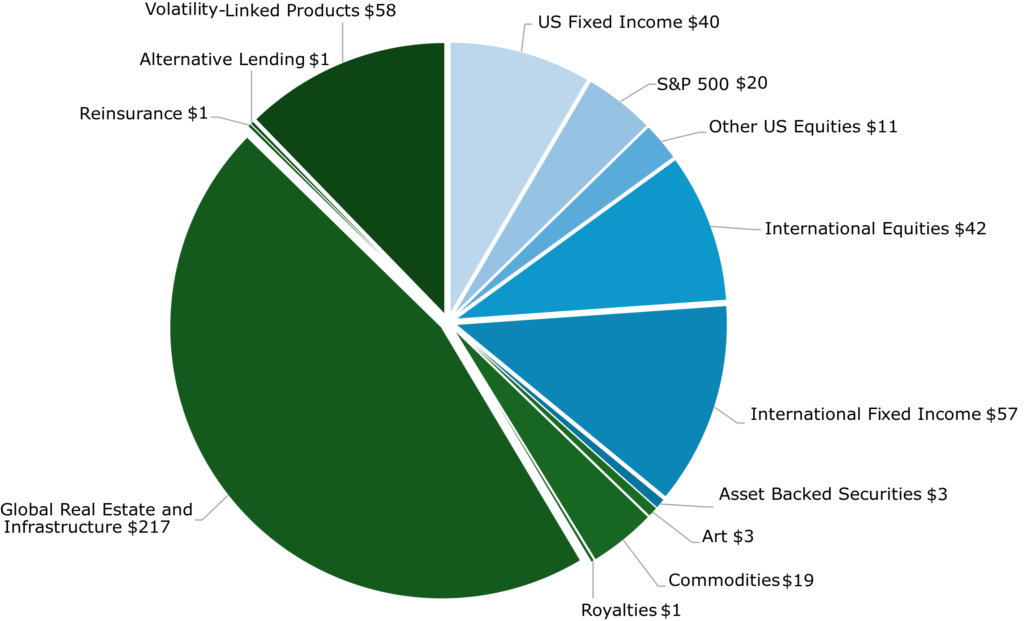

Wiser Diversification isn’t just a strategy; it’s the cornerstone of prudent investing. Nobel Prize laureate Harry Markowitz famously dubbed it the “only free lunch” in investing. Our approach offers you access to a broader spectrum of global assets. From real estate to alternative lending, we ensure your portfolio benefits from the entire wealth of available investment opportunities, not just a fraction of it.

Data Source: Stone Ridge, Illuminating the Path Forward. Amounts are displayed in trillions of dollars.

Minimizing Volatility

Adding additional asset classes reduces the risk of the portfolio with minimal or no loss in expected return. By utilizing more than just the typical 60% stocks and 40% bonds standard portfolio, you can reduce the probability of big losses.

Maximizing Opportunity

Our strategy has historically resulted in above-market performance for more than two decades, through all market environments. Historically, we have outperformed during difficult bear markets but have participated in bull markets.

Protection

Investing for and through retirement requires a conservative portfolio that minimizes drawdowns. Our last big bear market was 2007-2009. No one can tell you when one will occur, but we can say with certainty it will happen again.

Wiser Investing

By utilizing more than just the typical 60% stocks and 40% bonds standard portfolio, you can reduce the probability of big losses. Adding additional asset classes reduces the risk of the portfolio with minimal or no loss in expected return. This is the only free lunch in investing; similar returns at lower risk.

Get the free book that explains how it works.