St. Joe has Hidden Value in Discounted Real Estate Portfolio

| Price $44.25 | Growth Holding | March 13, 2025 |

- 1.25% Yield

- Owns 167,000 acres of land in the Panhandle of Florida, which we believe can be monetized at a current present value of at least $100 per share.

- The major Bay-Walton Sector Plan covering 110,500 acres slated for development through 2064, including 170k residential units and 22 million sqft of commercial space.

- Special zoning status reduces regulatory hurdles for planned residential and commercial development.

- Record-setting year for hospitality segment offset the slowdown in the region’s housing market after a boom in 2021-22.

- The Bay-Walton County area has an annual population growth rate of 3.2%, providing a secular demographic tailwind.

Investment Thesis

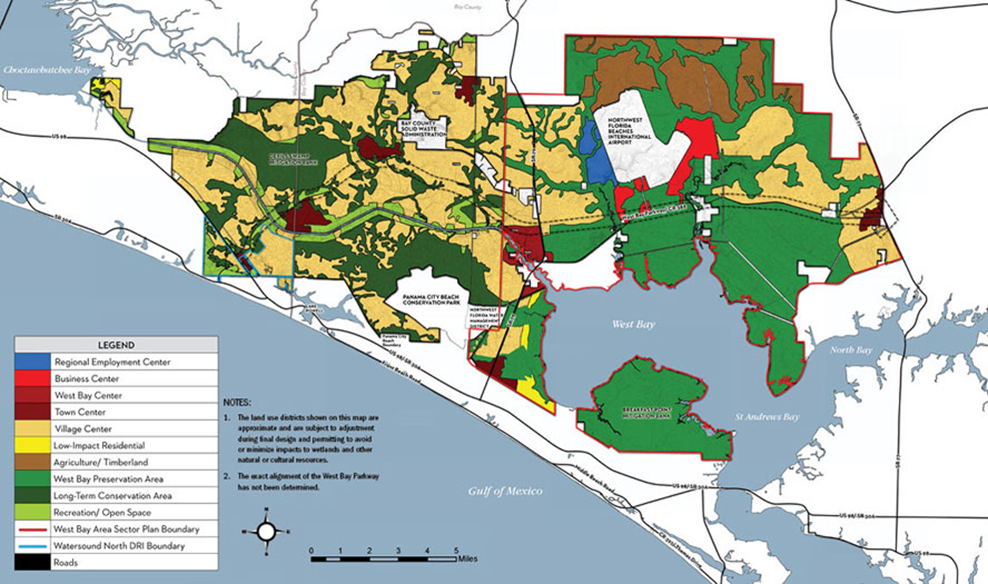

St. Joe Company (JOE) is a property developer located in North Florida, owning 167,000 acres. Over the long-term, St. Joe has a large-scale sector plan called the Bay-Walton Sector plan, which details 110,500 acres of development to 2064 including 170,200 residential housing units and more than 22 million square feet of leasable retail and office space. According to St. Joe, it realizes much of its revenue from under 2% of its land holdings. In 2024, Bay and Walton counties combined grew their populations by 4.8% to 283,840 people, with the 5-year average growth rate being 3.2%. Walton county in particular was the #2 fastest growing county in Florida between 2020-24, growing its population by 16.5%.

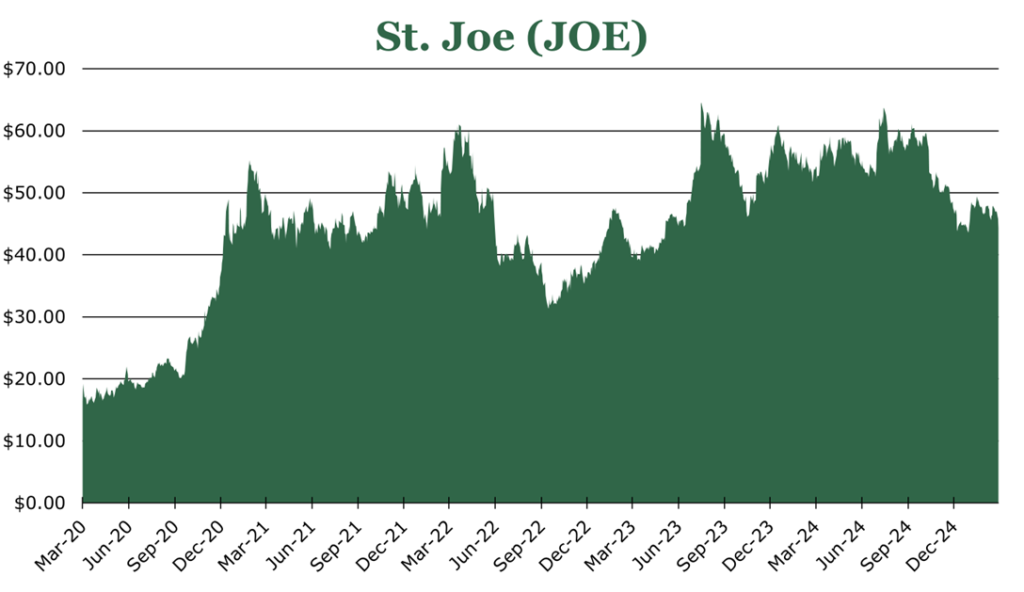

While the dividend is currently only 1.25%, over the long-term we believe that St. Joe has the experience to execute on the Bay-Walton Sector plan. Additionally, we believe that St. Joe trades at a discount to its underlying asset values. Much of the land it holds was acquired decades ago, previously used as timberland. Based on our analysis of the sector plan, the weighted average land value across the total portfolio of holdings is $53,543/acre. Net of debt and other assets, the market values St. Joe’s land at just $15,449/acre. With the housing market facing its most difficult market in more than a decade, the trailing twelve months has seen St. Joe’s stock price decrease by 18.5% providing a compelling entry point.

Bay-Walton Sector Plan

Of St. Joe’s 167,000 acres, 110,500 acres or 66.2%, is covered by the Bay-Walton Sector Plan. The plan goes through 2064 and represents one of the largest planned developments in Florida. The plan’s special zoning dictates that the area covered by the sector plan is not subject to some regulations related to building, such as demonstrating need before building new residential units.

| 2064 Plan | Walton County | Bay County |

| Residential (Units) | 24,706 Units | 145,494 Units |

| Office (sqft) | 113,000 sqft | 11,200,000 sqft |

| Retail (sqft) | 505,000 sqft | 4,500,000 sqft |

| Hotel (Rooms) | 530 Rooms | 2,775 Rooms |

| Hospital (Beds) | | 1,350 Beds |

| Industry (sqft) | | 6,000,000 sqft |

| Golf (holes) | 81 Holes | 342 Holes |

| Other Uses (sqft) | 322,000 sqft | 1,100,000 sqft |

The sector plan is further split into smaller DSAPs (detailed area specific plans). DSAPs representshorter-term plans of under 20 years, and elaborate on more specific uses of previously allocated land. As of July 2023, St. Joe had 5 approved DSAPs in Bay County, and 1 in Walton County.

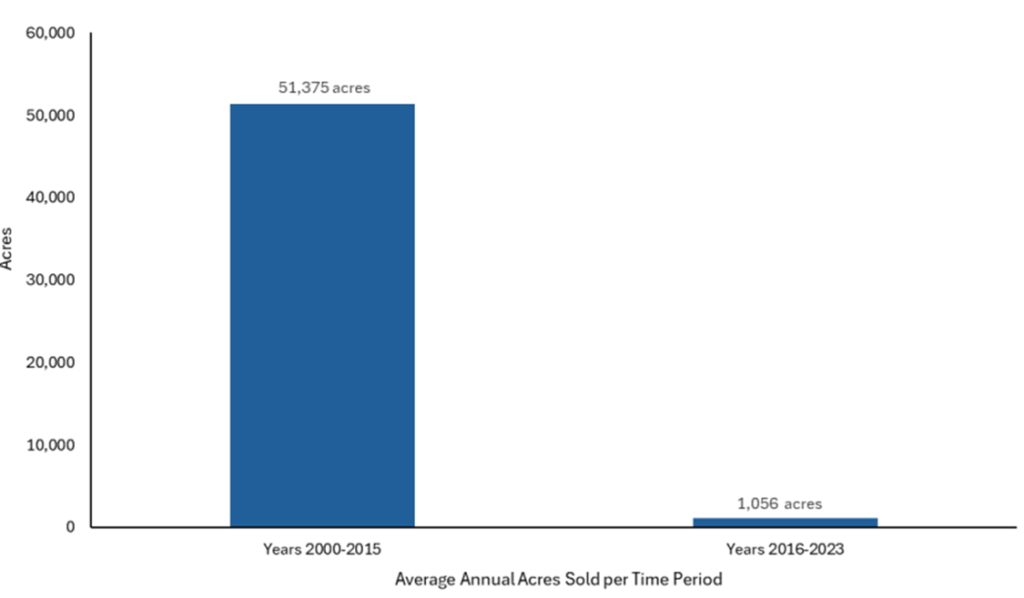

The remaining 33.8% of St. Joe’s land holdings are not included within the sector plan area and are largely made up of timberland. Since the approval of the plan in 2014, St. Joe has significantly slowed the pace of its real estate sales. We believe approval of the plan with its special zoning clarifies the underlying asset value and provides a path for continued intrinsic value growth.

Estimated Intrinsic Value

We have worked up an intrinsic value table. Please note that we do not claim any level of precision; it is merely a directional guide to the underlying intrinsic value. Think direction like north and not a precise location or number.

| Name | Description | Acreage | Potential Price/Acre |

| Unallocated Land/Timberland/Agriculture | Land not in the Bay-Walton plan, or allocated for timber | 63,234 | $28,391 |

| Dense Commercial | Park-and-walk retail centers. | 922 | $175,000 |

| Commercial Core | Grocery anchors, and office parks | 2,104 | $175,000 |

| Residential Development | Note 1 | 40,474 | $155,000 |

| Conservation | Designated or to be designated by the state or county as protected | 53,229 | $1,500 |

| Near-Airport Commercial | Retail and Office space near the airport. | 2,719 | $85,000 |

| Recreational | Parks, ponds, green space, golf courses, etc. | 4,318 | $7,500 |

| Weighted Average Price | 167,000 | $53,543 | |

Note 1: Residential is based on the Ward Creek development, which has been selling 0.15-acre plats to Toll Brothers for an average of $606,000/acre. For the full 66-acre phase 1 survey site, homes represent 16.8 acres — or a 25.5% coverage ratio bringing the average per acre to around $155,000.

As with any real estate sale, the total value can be highly dependent on market conditions, the proximity of the land to services, the proximity to other developments, cost of connecting and clearing, and zoning.

Already developed commercial properties such as hotels, retail, and golf courses are rarely sold by St. Joe. Additionally, before development the underlying land is more often granted to subsidiaries or JVs for improvement who then lease it rather than being sold. If there were to be a large scale sell off of operating commercial properties, we would expect them to sell at an EBITDA multiple rather than a per acre value.

| Description | EBITDA Multiple | Total Value | |

| Hospitality Segment | Includes marinas, hotels, clubs, and golf courses | 11.5x | $716,818,000 |

| Commercial | Retail, Senior living, multi-family and office. | 14.5x | $365,282,000 |

| Total | $1,082,100,000 | ||

| Component | Value |

| Land (above) | $ 8,941,639,994 |

| Operating Businesses (above) | $ 1,082,100,000 |

| Cash | $ 88,800,000 |

| Debt | $ (560,800,000) |

| Estimated Total Intrinsic Value | $ 9,812,675,994 |

| Intrinsic Value per Share | $163.76 |

Forestry and Non-Residential Land Sales

St. Joe harvested 256,000 tons of wood during 2024, with revenues declining by 14.3% due to lower realized prices. For more details on the current softwood lumber market, see our piece on PotlatchDeltic or Weyerhaeuser.

During 2024, St. Joe sold 634 acres at an average price per acre of $28,391, with the average sale containing 56.6 acres. While this price per acre is lower than the $44,304 realized during 2023, the cost per acre is heavily dependent on zoning and proximity to local amenities. Given the low price of these land sales, it is likely that much of it was outside of the sector plan area or was presently in an underdeveloped area.

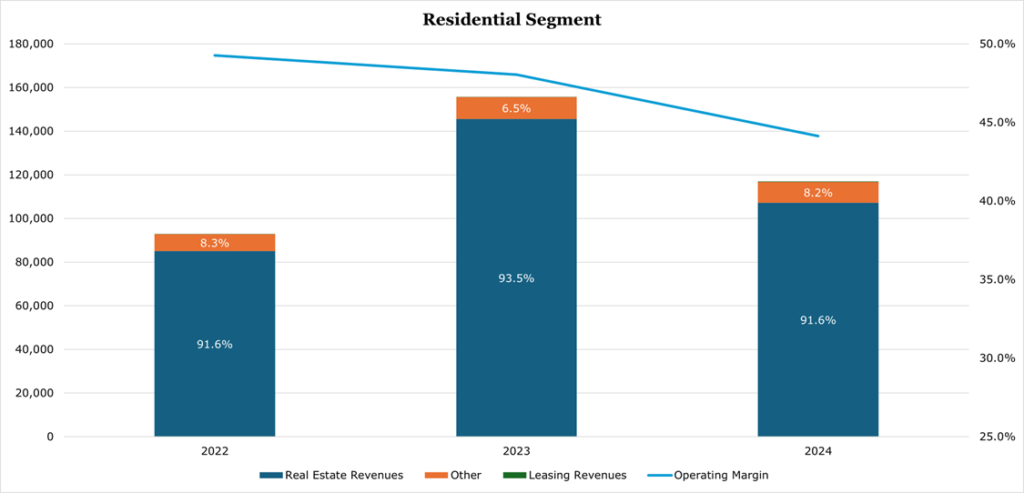

Residential

The residential segment contains the community planning and residential homesite selling business. For 2024, revenues from homesite sales declined 26.1%, due to a higher mix of lower-priced communities and timing from developers, as well as macroeconomic conditions. As of the end of February 2025, mortgage rates have averaged 6.73% and are expected to stay elevated through the end of the year. The seasonally adjusted pending home sales index in the South declined 8.8% year over, outpacing the rest of the country. While some moderate growth is still expected in the US housing market, JP Morgan expects the housing market to remain ‘largely frozen through 2025’.

St. Joe realizes residential revenue in components; it realizes up front revenue from plats sold to homebuilders and may realize a secondary residual if the homebuilder sells the home above a watermark level. Additionally, if the plat is sold to a JV partner, St. Joe may realize some additional equity income. On average, St Joe realizes between 45-50% gross margin on the sale of homesites, due to the cost of municipal services, permitting, and land clearing.

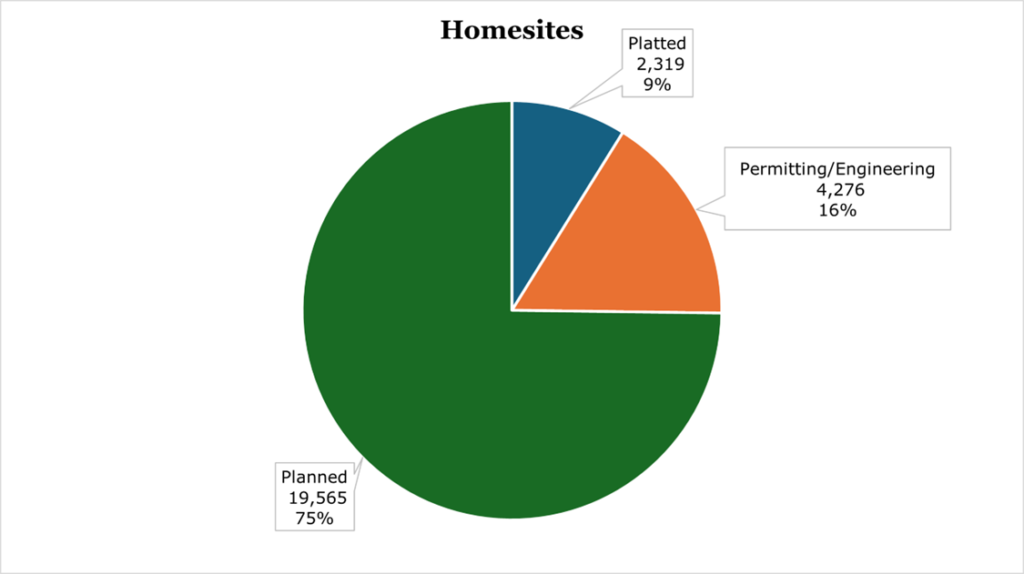

In the active development phase, St. Joe has 2,319 plats ready for building. Thus far for 2025, JOE has 1,074 commitments for home purchases, a 27.7% decline compared to 2024. Near-term expansion includes 4,276 plats in the permitting and engineering phase, with a further 19,565 actively planned.

Based on 2025 commitments, St Joe expects to realize $95,000 up front per sale, which represents a 19.2% decline. With rates high and a general slump in the housing market, the decline in revenue per home and volume committed is not concerning us in the short term. Additionally, the location, home type, and size of the plat heavily dictates realized prices which can cause some fluctuation independent of market conditions.

St. Joe’s current primary partner is Minto Homes, the operating partner of the 50%-50% Margaritaville JV. The Margaritaville JV has 367 commitments for home purchases for an average price of $618,300, which St. Joe will realize between 6-8% of as equity income. Given that St. Joe is the land contributor with Minto managing the building, marketing, and development we believe that the 50% JV offering 6-8% EBT margin is very favorable. However, the pace of Minto’s building has slowed, which we believe is due to the slump in the housing market.

Hospitality

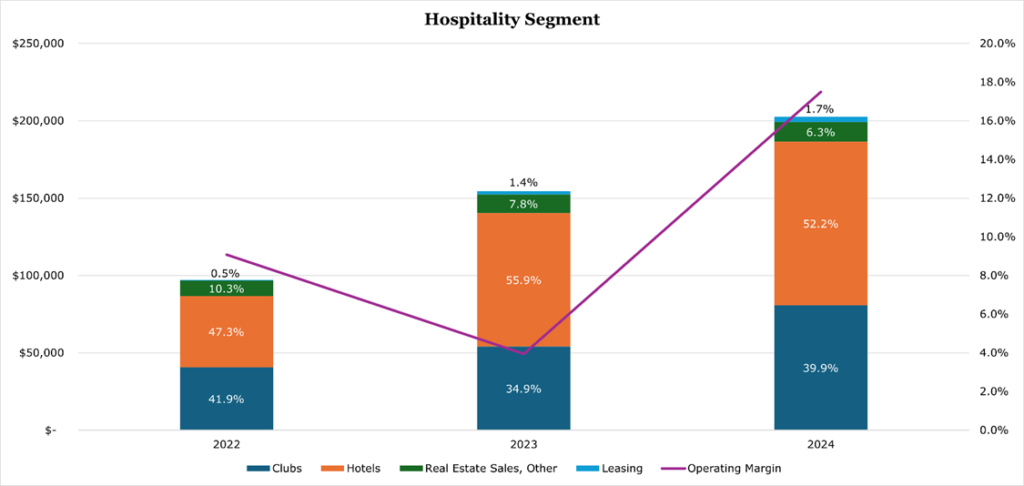

In the hospitality segment, revenues are made up by hotels, followed by club revenue with a smaller portion coming from leasing, marinas, and real estate sales. Total segment revenues grew 31.1%, with operating margins increasing substantially to 17.5% thanks to new openings.

Across Bay and Walton counties in North Florida, St. Joe owns 12 hotel properties with a combined 1,298 rooms. Of the 8 hotels St Joe operates, it has 1,053 rooms. Hotel related revenues increased 22.3% during 2024, with hotel gross margins increasing to 23.5%, which was due to the first fully operating year of 4 properties opened in 2023. Over the long term, only 1/3 of the planned 3,305 hotel rooms have been built according to the Bay-Walton sector plan. However, in the short term we expect the pace of hotel openings to slow down while commercial and residential development catches up.

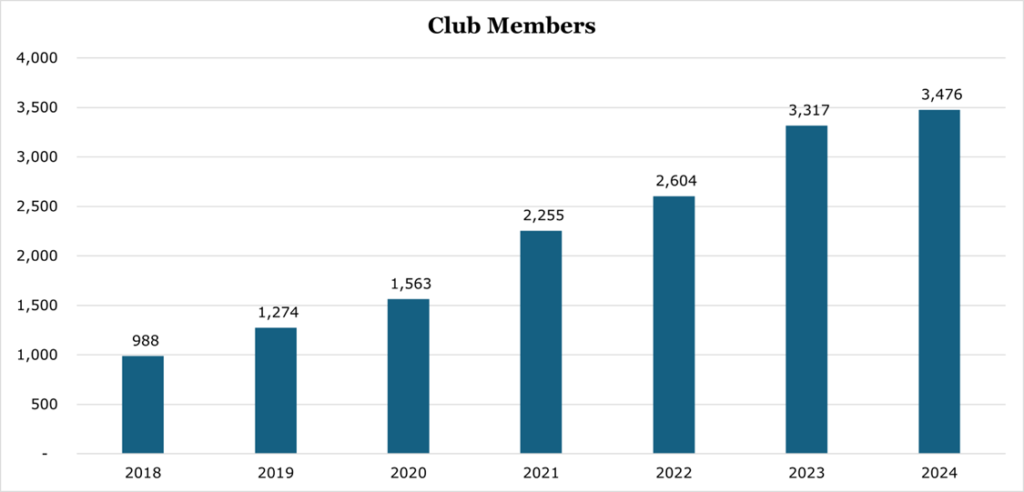

Club revenue is split between sales from amenities, such as golf courses, and membership dues. During 2024, club revenues increased 49.6% and gross margins expanding to 44.6%. The increase was due to both the increase in members and the first full-year operation of Camp Creek’s lodging and amenity facilities. We expect continued momentum in the club segment, with St Joe opening a third course on the Watersound Club property on March 20th.

During 2024, JOE added 159 new members, bringing the total members to 3,476. Membership at St. Joe’s clubs has two revenue generation components, an initiation fee and monthly fees based on the type of membership.

While St. Joe’s does not publish specific prices, it is likely monthly dues are between $600-$1,200 based on similar clubs and reported prices paid by members online. St. Joe’s initiation fee is $75,000 up front, which the realization is deferred over the expected life of the membership. Based on the unrealized revenue breakdown numbers, St. Joe expects to retain members for an average of 7 years. We expect a small boost in 2025 to membership given the large increase in membership in advance of the initiation fee going to $75,000 on January 1, 2024. We expect future membership growth to be more modest as the club benefitted from the unprecedented regional population surge in 2021-23.

With hospitality, the ‘other’ component includes operated retail stores, attached restaurants, and marinas. Through the end of 2024, revenues grew 5.8% with a gross margin of 15.7%, a small contraction compared to 2023.

Commercial

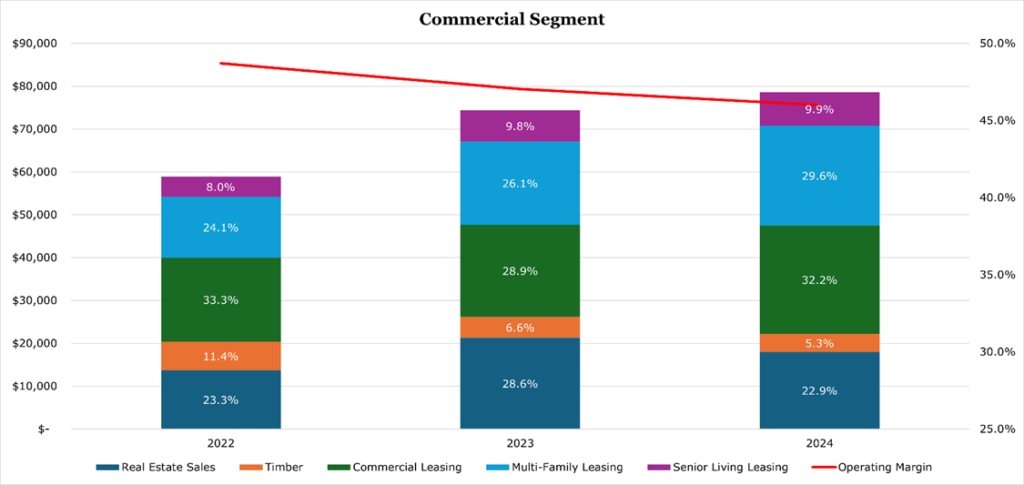

The commercial segment includes multi-family, senior living, retail, and office leasing. As previously discussed, lumber and non-residential real estate sales are included in commercial results. Overall revenues increased 5.6%, with margins contracting by 100bps.

Across 7 multi-family developments, which are not operated by it, St. Joe has 1,128 units, with 961 leased for an occupancy rate of 85.2%. While this is low for typical multi-family construction, it is about average for the Bay-Walton County area. Overall, for 2024, multi-family leasing revenues grew by 20.1%. We expect occupancy and revenue to increase during 2025, as 39 units have either finished renovations or been redesignated to allow for individual sales.

Senior living includes 255 units at an average occupancy of 56%, both of which are operated by a JV. The low occupancy is due to a new 148-unit Watersound Fountains independent-living facility which opened in March 2024, and currently has 26% occupancy. The existing Watercrest senior living facility ended 2024 at 96% occupancy and focuses more on assisted living and memory care. Overall, revenues in the senior living segment increased 6.8%, with gross margin increasing 480bps to 29.5%. We expect continued strengthening of senior living gross margins to increase as the cost of operating an independent-living facility are far lower than an assisted-living facility.

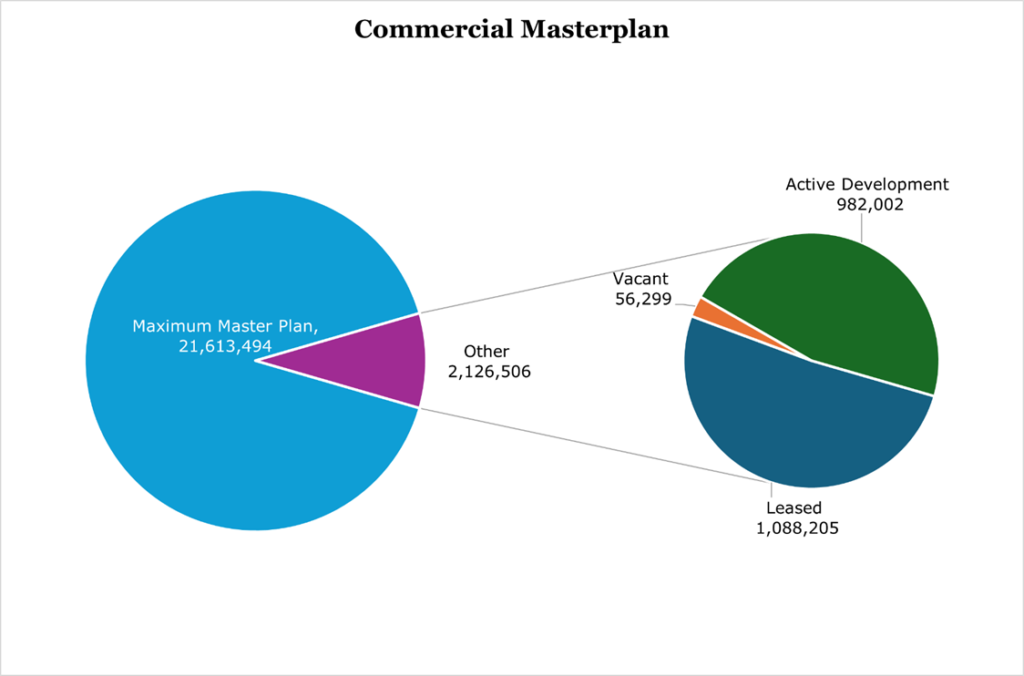

The commercial leasing segment includes both office and retail space. According to the previously discussed Bay-Walton sector plan, St. Joe has built 3.0% of the total allowed amount of commercial square footage. Currently, St. Joe has 982,002 sqft of space in active development, including a 241,330 sqft expansion for Florida State University’s medical campus in Panama City which will be 100% occupancy upon completion.

As of December 2024, St Joe had 1,144,504 sqft of commercial space for lease, with a 95.1% occupancy rate. Commercial leasing revenues increased 17.7% despite a smaller 9.2% increase in leasable space. Due to construction completion, much of the new leases are at higher rates which helped boost gross margins to 66.0%.

Risk

An unquantifiable risk facing St. Joe is hurricanes and possible climate change. Of the 167,000 acres of land owned by St. Joe, 90% is within 15 miles of the Gulf Coast which creates demand but negatively makes it a risk-zone for storm surge and extensive hurricane damage. Insurance in Florida has become more expensive for insurers, with many electing to leave the state altogether. This is negative for future demand as costs go up to insure, but a direct hit hurricane would lessen the attractiveness of the area until repairs and rebuilding could occur.

St. Joe frequently backs debt from JV’s, guaranteeing 50-75% of the principal balance falling off after a time decay or after a certain amount of principal is repaid. Thus far, no St. Joe JV has ever defaulted on a loan, and we do not expect off-balance sheet obligations to weigh down St. Joe in the future, even in an economic downturn.

Outlook

Full company revenues grew 3.46%, with record-breaking hospitality revenues offsetting the decrease in residential real estate sales, with operating margins flat year over year. According to St. Joe’s investor day presentation, sustaining capital investments required for existing assets was just $8.0 million annually. Additionally, depreciation, which is a non-cash expense, is more than $0.80 per share annually.

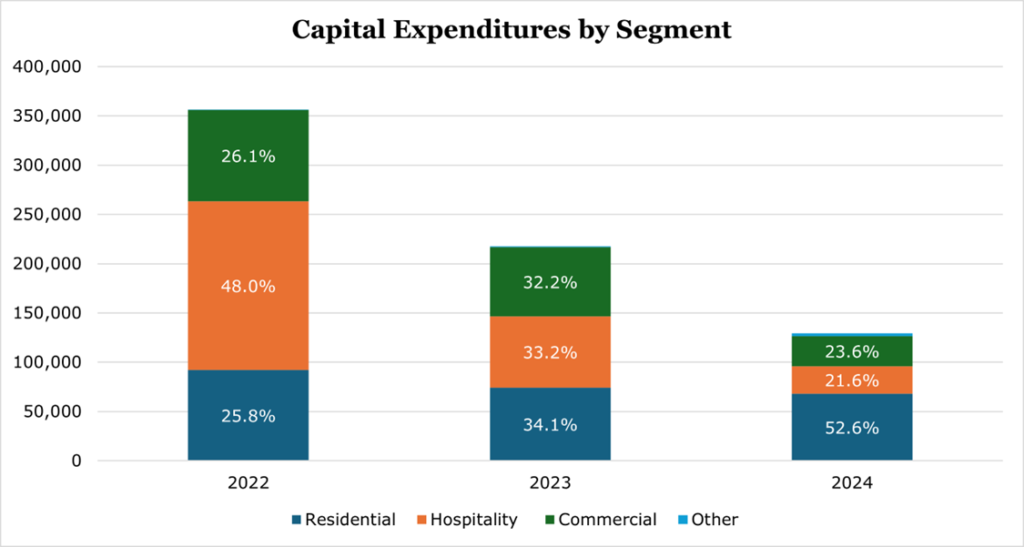

During 2024, St. Joe spent $129.4 million in capital expenditures, with 52.6% going toward developing residential land, with the rest split evenly between hospitality and commercial uses. As previously discussed, we expect capital expenditures to be more focused on residential development in the medium term, with previous year spending more focused on expanding hospitality and retail space.

St Joe ended 2024 with a $88.8 million cash position, and a debt to EBITDA of 3.9x. We believe that this debt figure is mostly asset-backed debt, and thus the higher multiple is acceptable. According to St. Joe, its weighted average interest rate is 5.3%, with an average remaining term of 17 years.

Conclusion

In the short term, the underlying real estate and business value appears to be higher than the stock price. Moreover, Gulf Coast real estate will most likely continue to appreciate at 5-10% per year as it benefits from demographics and inflation. Over the long-term, St. Joe needs to execute its plan of turning its land into one of the largest planned communities in North America. With more than 4.1 million Americans retiring each year, and the Bay-Walton county area growing its population by 8,330 people or 3.4% per year, St. Joe is poised to capitalize on this favorable demographic tailwind.

Peer Comparisons

| St. Joe Company (JOE) | RMR Group (RMR) | Tejon Ranch (TRC) | Cushman & Wakefield (CWK) | Newmark (NMRK) | |

| Price-to-Earnings | 36.07 | 18.99 | 158.60 | 19.84 | 36.88 |

| Price-to-Sales (TTM) | 6.63 | 1.53 | 10.15 | 0.27 | 0.79 |

| EV-to-EBITDA (TTM) | 22.66 | 6.48 | NM | 10.13 | 13.58 |

| EBITDA Margin | 35.25% | 35.61% | -10.99% | 5.41% | 11.89% |

| Dividend Yield | 1.25% | 9.72% | – | – | 0.96% |